The FOMC meets next week. Tomorrow will bring more economic news.

QE is not over by a long shot. They may call it something else. They may wrap it in a different package. And the government may finally get busy and do some decent economic planning for growth rather than this interminable infighting and divvying of loot.

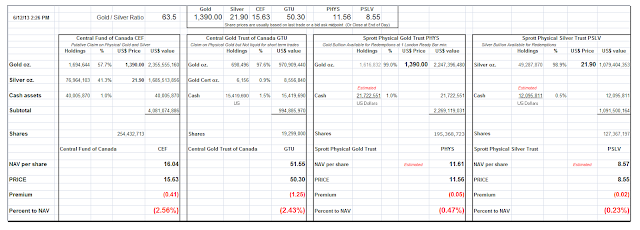

People may wish to protect some of their wealth from expropriation. There are a number of things one may do if you have not done so already.

One of the things you may wish to do is to watch The Hunger Games if you have not had time to read the books. I think that the dystopia it portrays is as possible as 1984 or a Brave New World. Or perhaps even something by Charles Dickens.

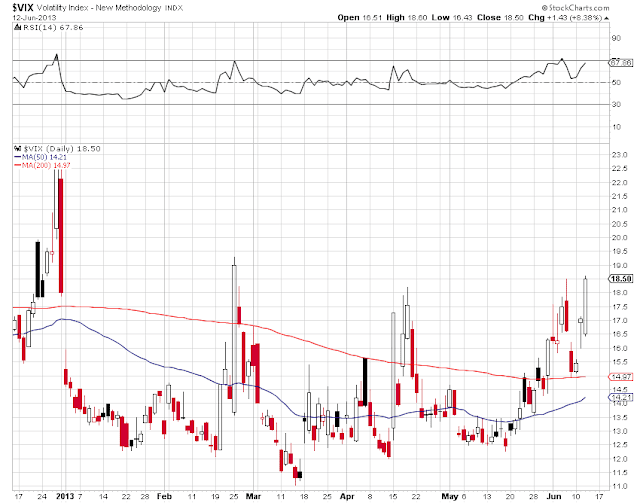

The price manipulation in the markets is fairly obvious for anyone who wishes to look and see it. I mean, really.