30 July 2013

29 July 2013

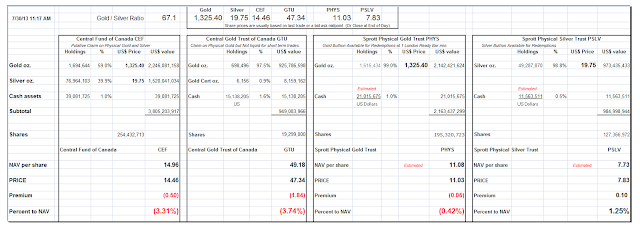

Gold Daily and Silver Weekly Charts - Slogging Slowly Through an FOMC and GDP Week

“I worry about the effects on the long-run stability and efficiency of our financial system if the Fed attempts to substitute its judgments for those of the market.”

B. S. Bernanke, 15 October 2002

Jawboning for the first part of this week from the Fed, and a pseudo-random number may pop out as GDP.

So by default the Jobs Report will be the big market mover, and probably undeservedly so.

Goldman reiterated its call for a sell in gold, as did the big Roubini.

Talk is cheap. Stand and deliver.

SP 500 and NDX Futures Daily Charts - Econ Heavy Week from Wednesday Forward

The real action this week will start on Wednesday with GDP and the FOMC decision.

I doubt very much that the Fed will do anything at this meeting, but there may be more taper talk.

GDP may be a tough call because I hear that they are going to be revising the data back to Christopher Columbus. So who knows what they may provide.

Therefore I think if there is a market mover this week it will be the Jobs Report on Friday.

Subscribe to:

Comments (Atom)