When the Exchanges crash and burn, do they dream of electronic sheep?

Well, I cannot say if they dream or not, but you may as well be dreaming of electronic money, if that is where you keep your wealth, and it is lost somewhere in an electronic storm. You are reliant on the integrity of the exchanges and their owners for restitution. Often it works out well, and things go on as normal. But as the dominoes of counterparty risk start falling, it is 'might makes right' as we saw in the mysterious case of MF Global.

I hear that Obama was 'informed' of the problems on the NASDAQ today. I assume that is a symbolic gesture designed to inspire confidence. And it is as practically futile as giving the Princes of Wall Street a big pile of the public's money to keep their doors open in a collapse of their own causing, and expecting them to 'do the right thing' for the sake of the country.

Gold and silver held their ground today, and are very obviously coiling. You can see it more clearly on the gold daily chart. The odds are it will break to the upside, but there seems to be a determined effort not to allow the metals to break and run, but to keep them well leashed.

I have included two charts of gold in grams priced in Indian Rupees to show the remarkable recovery gold has made from the lows despite the extraordinary efforts being made by the Reserve Bank of India and that government to stop the flow of gold into the hands of ordinary Indian people who are seeking their traditional safe haven for their wealth.

At some point the leash that is holding gold back is likely to break, and then the price will find its own level, though the heavens may fall. Or at least a few of those demigods that think they are doing God's work.

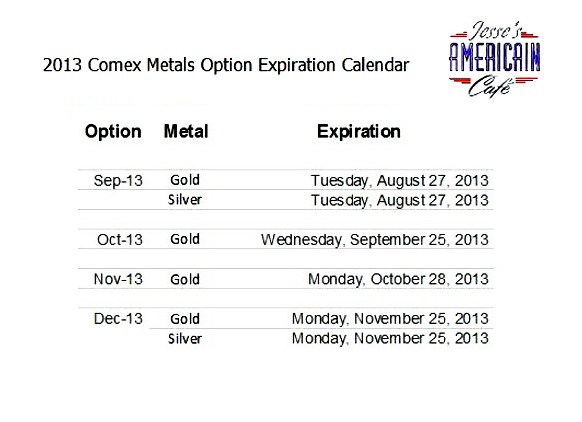

As a reminder, next Tuesday 27 August is option expiration for gold and silver on the COMEX. And Friday 30 August is the last delivery day for August.

There could be some interesting cross currents next week.