"Mark where his carnage and his conquests cease!

He makes a solitude [desert], and calls it — peace."

Lord Byron, Bride of Abydos

Gold in particular was under pressure since yesterday evening, with a concerted effort being made to hold the line on price around the $1400 level.

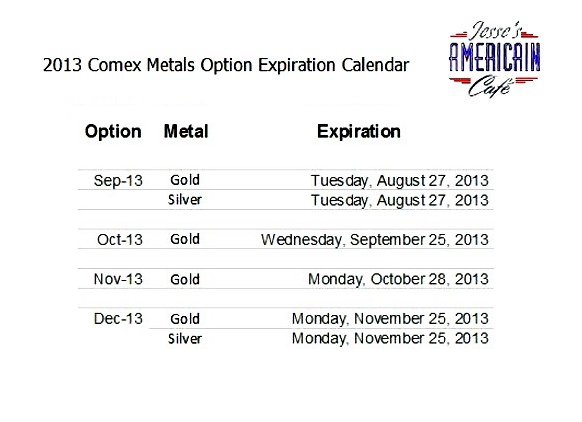

This is a big week for gold and silver, with COMEX option expiration tomorrow, and the end of August delivery on Friday, with available inventory at record low levels for this bull market. There was intraday commentary on this here.

Stocks did a reversal and gold and silver popped like coiled springs when US Secretary of State John Kerry vowed that the US would respond to 'the moral obscenity of massacre in Syria.'

Smells like teen spirit, and the invasion of Iraq. And the markets reacted accordingly.

The economy may be floundering, the leadership may be compromised, and the majority of those over the age of 18 within the Washington Beltway may be on the take, even if indirectly, but there is always the ability to bring the blessings of democracy and the Pax Americana to those who require it, whether they wish it or not.

Let's see how gold and the equity markets manage their way through the rest of this week.

Stand and deliver.