"Nearly all men can stand adversity, but if you want to test a man's character, give him power."

Abraham Lincoln

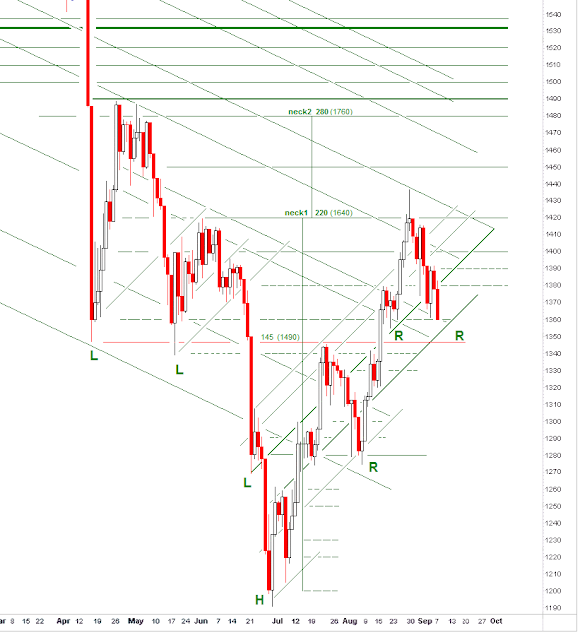

I think that the formation of the inverse head and shoulder is apparent.

Let's see if it breaks down, or activates by breaking up through the neckline.

As an aside, Google Blogger seems to be having some issues, and the quote on the header is problematic for now. These are not changes I have made. I suspect someone messed with the header macro in Java, and I cannot fix that without a major rewrite of the template which I am loathe to start.

By the time I achieved something they would have fixed it, and I would have something non-standard and awkward to maintain. Been there, done that, too many times. Best to wait for whatever was broken to either be fixed or replaced by its pristine backup.

They are making some changes, and have apparently broken something in the process. I thought that it was Yahoo which specialized in that sort of project management.

I am encountering some other problems with the site behind the scenes as well.

Let's give it a few days. And the same patience is required for this gold chart formation to work itself through its current consolidation.

Life can be disappointing at times. And I think quite a few people have come to the conclusion that among those disappointment's is President Obama, the reformer, and the Congress.

I am about half way through

This Town by Mark Leibovich. I do not know that I would recommend it for everyone, but I am enjoying it because quite a long time ago I swam in those waters, and had friends in the political business with whom I kept in touch. I know the types, and some of the players, so the gossipy elements of the book are enjoyable. I can easily see where they could become very tedious to someone who was not familiar or interested in that sort of thing.

Other than the personal details of famous and nearly famous people and their idiosyncrasies and antics, the book is useful because it highlights the bipartisan dedication to personal advancement and greed that has possessed the heirs of the 'Me Generation.' Politics is always a dirty business, and it therefore always attracts vile creatures. But when their venality becomes not only accepted but the fashion, then their hypocrisy and toleration of soft bribery knows no bounds.

The book shows how bad things can get when virtue is no longer held in high esteem, and the shame of dishonour, dishonesty, and deceit no longer carries any social sanctions or financial repercussions. It is the story of moral hazard written in capital letters. And we are not done with it yet.

Reform in such environments is a risky business, because reform involves a shift of power. And power brings out the worst in people. The cure is often as bad or even worse than the disease. But change will come, one way or another.