18 September 2013

Federal Reserve Decides Against Even Token Taper - Baby Bears Spanked by Blythe

I was a little surprised that the Fed did not take the opportunity to do at least a token taper to end the speculation about 'when.' The market had clearly priced it in. But the buts in the statement are significant.

I think their major concerns are that higher interest rates will kill the housing market and consumer demand, which are both in a weak recovery. And the potential of a debt limit showdown looms over the Fed without a doubt. Mortgage debt is important, but the sovereign debt is the entire game.

The capping of gold and silver this week was trader games and perception management, nothing more.

The fundamentals may not always prevail, but they matter in the longer term.

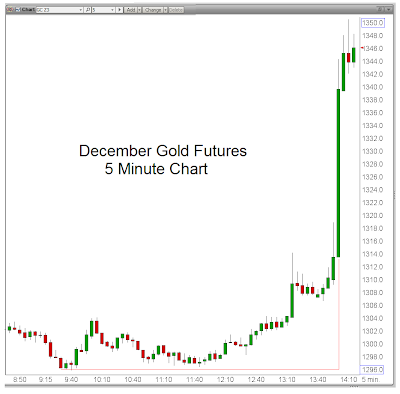

The Right Shoulders on the gold and silver charts look like they are now in, but we must break the resistance and then the neckline to confirm. Notice that the daily high on the short squeeze stopped right on it at big resistance of 1350 to 1360. I think the real test will come at the first neckline as the funds square up and get long. What we are seeing today is the trap, sprung.

The COMEX precious metals trade has hardly turned into an efficient and transparent market in one day. I suspect that physical offtake will force their hand, and probably from without, on a more physically oriented exchange that declares bids without offers at price, and then a market dislocation follows. It may occur in the forex markets, and that would be significant.

The COMEX may lead, but will more likely follow since it is, after all, a fiat exchange whose day has past, having diverged badly from the reality of world markets, unless it changes with the times.

Hey, do you think the biggest banks on Wall Street had any with the Fed about their decision today? Goldman just came out with another bear call on gold. But open interest to registered gold inventory suggested that these prices were already untenable and likely to break to the upside.

COT analysis suggests JPM had closed their gold shorts and went net long in the last couple of weeks. ROFLMAO

Release Date: September 18, 2013

Information received since the Federal Open Market Committee met in July suggests that economic activity has been expanding at a moderate pace. Some indicators of labor market conditions have shown further improvement in recent months, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has been strengthening, but mortgage rates have risen further and fiscal policy is restraining economic growth. Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee’s longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished, on net, since last fall, but the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labor market. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee’s dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In judging when to moderate the pace of asset purchases, the Committee will, at its coming meetings, assess whether incoming information continues to support the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective. Asset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s economic outlook as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Charles L. Evans; Jerome H. Powell; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

Play it again Sam, play it for old time's sake.

Category:

FOMC,

gold manipulation

What Is a 'Credibility Trap'

A credibility trap is when the lies and the corruption become so widespread and embedded in a system that they become self-sustaining to the point of moral bankruptcy.

It is when almost half of all Congressmen remain in the Capitol after leaving office so that they can make many millions per year peddling influence and crafting loopholes for corporations who are offering huge sums to gain advantage through manipulating the tax and regulatory laws, or eliminating them altogether.

It is when politicians leave office voluntarily once they have gained enough name recognition and contacts so they can cash in.

It is when a ruling class forms, and becomes insulated from their constituents. It begins to act for itself, paying lip service to their oaths and obligations, with no consequence or shame.

It is when the government by example breeds lawlessness.

It is when officials from the Executive Branch move back and forth through a revolving door from corporate institutions in order to make the big payday for their public 'service.'

It is when the truth is led down a blind alley of greed and strangled by expediency. It is when lying and cheating is acceptable, even laudatory, if you are good at it. And goodness is measured in money.

It is when corporations openly pay large bonuses to their executives who win an influential job in government in order to further the corporation's influence and interests.

It is when there is more moral hazard in not taking the money, than there is in taking it, and even getting caught at it, as long as you have served your masters well. If you do not take the money, you are a risk, you are not reliable. You may have a conscience, and you do not have the additional layer of loyalty that comes from complicity. Morality is bad for business. And good people are contemptible.

It is when the only tragedy is not to be in the one percent.

If you wish to see a fine example of this type of systemic corruption, watch the movie Serpico, or a good expose of a banana republic or organized crime, or read the book This Town by Mark Leibovich.

Groupthink rationalizes it, and the fear of ostracism and missing the big payday keeps everyone in line. And once you are part of this type of system, it owns you, whether you are a politician, a journalist, an economist, or a parasitic enabler. If you are in business, not to join in is a competitive disadvantage. Bad behaviour drives out the good, and banality unleashing the darkest parts of human nature is in the ascendant.

A credibility trap is when both parties pledges themselves to the powerful, monied interests, thereby putting the business of business ahead of the business of the people. The society becomes out of balance, and cannot bring itself to right because its leaders have lost their way, and corrupt all who come near them.

It always ends, often from external forces, and too often badly. But while the money is still flowing the band plays on.

"A credibility trap is a condition wherein the financial, political and informational functions of a society have been compromised by corruption and fraud, so that the leadership cannot effectively reform, or even honestly address, the problems of that system without impairing and implicating, at least incidentally, a broad swath of the power structure, including themselves.

The status quo tolerates the corruption and the fraud because they have profited at least indirectly from it, and would like to continue to do so. Even the impulse to reform within the power structure is susceptible to various forms of soft blackmail and coercion by the system that maintains and rewards.

And so a failed policy and its support system become self-sustaining, long after it is seen by objective observers to have failed. In its failure it is counterproductive, and an impediment to recovery in the real economy. Admitting failure is not an option for the thought leaders who receive their power from that system.

The continuity of the structural hierarchy must therefore be maintained at all costs, even to the point of becoming a painfully obvious, organized hypocrisy.

Category:

credibility trap

17 September 2013

Gold Daily and Silver Weekly Charts - Begin the Beguine

It is all about the Fed tomorrow and what level of market intervention they will maintain in buying public and private (Treasury and mortgage) debt.

I think a mix of both with a total below $10 billion may be a likely expectation. I think the taper will be slow, and the unwind of the balance sheet even much slower. I think we are looking at quite a few years, and not months. We will know once the economy has actually improved and we are certainly not there yet. Not with a stagnant median wage which dampens consumer demand.

There is a serious risk of a market dislocation, either in the dollar or stocks or both. I have not quite gotten a better feel for which way it will roll as it depends on some exogenous variables that I am insufficiently connected to foresee.

Either way, we can keep reading the short term signs. Gold and silver are coiled and look explosive, but given time. Timing is everything which is why cautious diversity is not a bad idea.

I was rereading some of Roger Babson's writings today, and came across the Babson Boulders of Dogtown which I had not known about that I can remember.

It is seems odd that I had never even heard of them because I had taken frequent car rides past that area while at school along the coast from Boston to Ipswich to visit friends who lived near Crane's Beach. I remember Rockport and Gloucester quite well, and the obligatory stop at Woodman's Tavern in Essex.

It wasn't like I did not get out on the weekends. I once made the trek to Thoreau's location on Walden Pond and left my own stone on the pile that commemorates it. I even took the trip to the House of the Seven Gables at Halloween for the witches convention. That was interesting.

I am a big enough fan of Babson to have walked his trail if I had known of it when it was handy. But I did not have an interest in financial things and Roger Babson until after an MBA sparked a keen interest in economics at 40. Until then it was all gizmos, gadgets and coding. And the classics, history and literature of course. But that was due to youthful whimsy, which is why it is the best time for exploring your options, and walking a trail lined by scattered old boulders with carved sayings from a man who had also seen the consequence of human folly approaching.

Have a pleasant evening.

Subscribe to:

Comments (Atom)