All those happy momentum buyers of paper gold and silver, GLD and SLV, got a stiff gut check today, especially if they were playing the miners and ETFs with options, because gold and silver took a determined bear raid selloff in honor of the September triple witching expiration today. It happens four times per year.

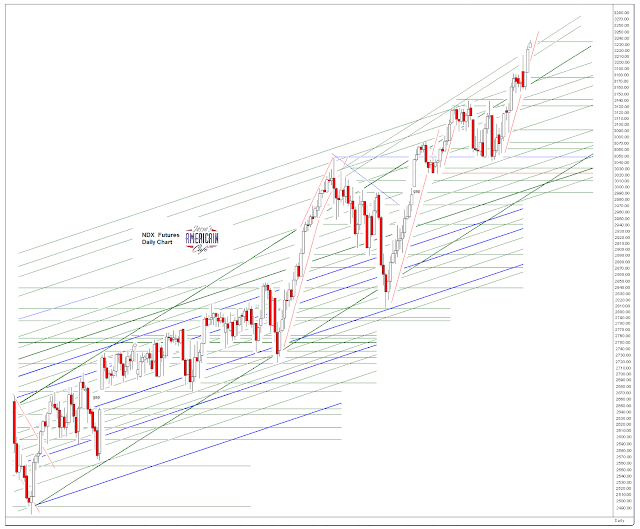

The front month in SP 500 and NDX stock futures is now December. Can you believe it? Where has the summer gone?

Next week is the COMEX futures option expiration on the 25th which is Wednesday. So we might see the usual up and down action around that time.

Paper metals are a speculative trade, and playing them with options is gambling. And I think 'the house' cheats.

So take it for what it is worth. If you do it, you may look forward to many days like today.

As you may recall, September is not a big delivery month and there has been a lack of serious movement of bullion in and out of COMEX warehouses the past week. It could pick up a bit as the month closes next week, but I would look forward moreso to October and December for possible test of inventory levels.

I am already watching December gold and silver futures, which is more of a personal quirk, since they do not follow the same pattern as stocks.

As you know I have said that the empire of the precious metals cartels will fall apart from the edges first, with the core of it in London and New York to go at the last. It could happen differently, but that is what I think.

Have a pleasant weekend.