NAV premiums remain very thin, with the only real enthusiasm showing up in the Sprott Silver Trust.

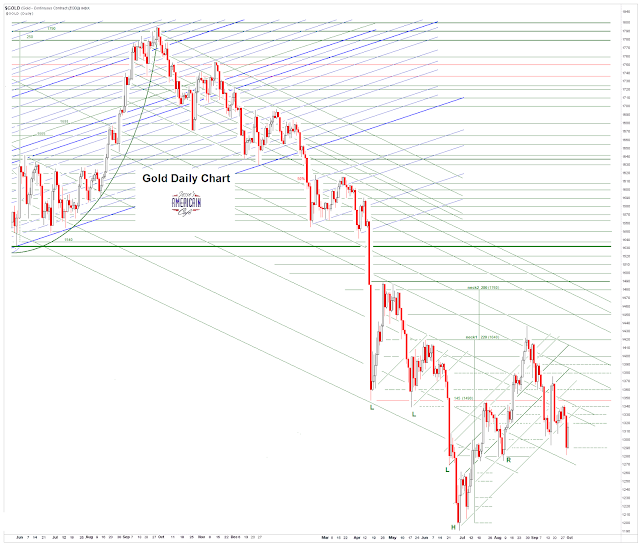

The capping on the metals is hard to miss, and the miners are in a ditch.

I picked up some mining positions today for the first time in a while. As you know my major bias is to have a claim on bullion more directly. And as is shown in the second chart below, the miners have been performing rather poorly to say the least, underperforming bullion for quite some time.

I have been studying the enormous decline in gold bullion from the world's ETFs and funds this year. What is remarkable about it is that there is no decline in silver, platinum or palladium, and in fact they have increased slightly.

It is not clear to anyone I speak with as to the cause of this, except for some off hand speculation along the lines of Ted Butler who thinks that those who like silver are more persistent, and some others thought that funds (John Paulson) were liquidating big positions and that GLD was disgorging in the process. That could be but it does not speak to the COMEX. That would be easier to accept if silver had not declined in price YTD even moreso than gold.

I will continue to look at it. The biggest declines are on just a few vehicles including the COMEX and in GLD, on the order of over 700 tonnes or so. The short interest on GLD is in the 9+ percent of float, if that number is accurate.

If gold does break and run, given the known shortness of available gold bullion supply, I suspect that we might see a wild ride as supply dries up and the ETFs and COMEX have trouble buying back what they have disgorged this year.

If anyone has a nice chart of the units outstanding for GLD and SLV for the year I would not mind seeing them. Otherwise I am going to have to extrapolate the authorized shares from the GLD spreadsheets and then try and estimate the short interest addition to it.

GLD management seems to have a target amount of gold bullion ounce per unit that they seek to maintain. That number has declined steadily since inception which I would imagine is how they account for the funds expenses.

I have a number of hypotheses about what could be causing this odd asymmetry in bullion holdings and lease rates and forwards. But I would rather continue to give this some thought and continue to look more deeply into some of the spreadsheets before saying anything more. I was at the GLD spreadsheet and one that showed the bullion levels for about twenty five major sources for the past year for hours yesterday. I keep thinking I am missing something. But I am in good company.

One thing I do know is if gold does break out and runs higher its going to be like the Wild West in the scramble for deliverable supply. No wonder the wiseguys are capping it so assiduously.