"We find our population suffering from old inequalities, little changed by vast sporadic remedies. In spite of our efforts and in spite of our talk, we have not weeded out the over privileged and we have not effectively lifted up the underprivileged. Both of these manifestations of injustice have retarded happiness.

No wise man has any intention of destroying what is known as the profit motive; because by the profit motive we mean the right by work to earn a decent livelihood for ourselves and for our families.

We have, however, a clear mandate from the people, that Americans must forswear that conception of the acquisition of wealth which, through excessive profits, creates undue private power over private affairs and, to our misfortune, over public affairs as well. In building toward this end we do not destroy ambition, nor do we seek to divide our wealth into equal shares on stated occasions.

We continue to recognize the greater ability of some to earn more than others. But we do assert that the ambition of the individual to obtain for him and his a proper security, a reasonable leisure, and a decent living throughout life, is an ambition to be preferred to the appetite for great wealth and great power."

Franklin D. Roosevelt, 1935

"They were ruined, when they were required to send laboring children to school; they were ruined, when inspectors were appointed to look into their works; they were ruined, when such inspectors considered it doubtful whether they were quite justified in chopping people up with their machinery; they were utterly undone, when it was suggested they need not always make quite so much smoke.

Besides Mr. Bounderby’s gold spoon which was generally received in Coketown, another prevalent fiction was very popular there. It took the form of a threat. Whenever a Coketowner felt he was ill-used, that is to say, whenever he was not left entirely alone, and it was proposed to hold him accountable for the consequences of any of his acts—he was sure to come out with the awful menace, that he would ‘sooner pitch his property into the Atlantic.'"

Charles Dickens, Hard Times

05 November 2013

NAV Premiums of Certain Precious Metal Trusts and Funds - Plus C'est la Même Chose

Category:

NAV of precious metal funds

04 November 2013

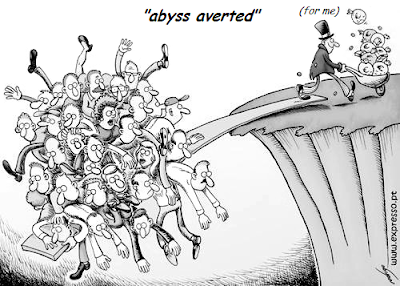

The Massive Drawdown of Gold From the West Continues - Silver Comparison - the Abyss

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, September 1999

“In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists.”

Eric Hoffer

Here is the change, in tonnes, in the inventory of major exchanges and ETFs for gold and silver since the beginning of the year. Nick Laird of Sharelynx.com was kind enough to share the data which he has collected with me. He does a remarkable job in maintaining an enormous amount of data at his site.

As you may recall, both silver and gold have seen price declines since the beginning of the year. As a reminder, silver is down 28.7% and gold is down 21.5%. I show this in the last chart. So they have both seen comparably stiff price declines this year.

Since the beginning of the year, the major exchanges and ETFs for silver have added about 1,494 tonnes of bullion.

But what is absolutely remarkable is that since the beginning of the year the Comex and some of the major ETFs have LOST about 856 tonnes of gold bullion. And I suspect much of that bullion has gone to the non-reporting vaults in Asia and the Mideast. And there is import/export data that corroborates that hypothesis.

Now, some might say that they don't see what this means, that they don't see the significance. Or that the significance is that people like silver but don't like gold, even though both have seen price declines, and even though demand for physical gold in Asia and the Mideast has been explosive this year according to trade records.

I will tell you what the significance is. The significance is that you are, figuratively speaking, watching water running uphill and out of sight. And some look at this and say, nothing to see here.

That gold which is disappearing from the reporting grid will not be coming back to these largely western vaults anytime soon. And it certainly will not be coming back at these prices. It is going into some fairly strong hands with an eye to the long term.

Silver is still acting like a precious metal, similar to platinum, which added 21 tonnes, and palladium which added about 1.5 tonnes.

Here is what is happening, as shown in the three charts below. Draw your own conclusions. But keep in the mind the negative gold forward rates and record leverage in potential paper claims for physical gold that we are seeing and hearing reported.

And this chart does not include the leased gold that is being occasionally disclosed by Western central banks, which seems to be going to satisfy the appetite of Asia.

It seems pretty darn obvious to me that there are some big buyers outside this reporting system that are taking down supply, and at a fairly aggressive rate, especially in the last twelve months.

You know that I think this exercise was triggered by the revelation that Germany's gold was missing, and a reflexive price manipulation that was intended to dampen demand, but instead set off an avalanche of physical buying.

Given that genuinely new gold supply is only added slowly from mining, once the West realizes what is happening the turnaround could take on the character of a short squeeze, and perhaps even a panic and market dislocation to the upside.

And if you are one of those who are holding receipts for gold held in this system, you may find that you have been rehypothecated with extreme prejudice, and given a forced cash settlement at another's discretion. When the time comes your assets may be found to have been used as cannon fodder in the currency war. Thank you for your support.

The German people asked for their national gold back, and were told by the Fed to go sit down in the lobby for seven years and wait for it. Are you kidding me? What is it going to take to wake people up that something has gone seriously wrong in these markets?

What kind of new fraud or disclosure of fiduciary misbehavior will it take to bring the dawn? And what will happen when the dawn finally comes? Do you wish to be standing in a very long line holding a warehouse receipt or brokerage statement? Good luck with that.

You may be a financier, fearing the abyss and hanging on, obsessively doing what worked in the past. But here is some news. You don't have to fall into the abyss, the abyss is coming for you. And the longer this nonsense continues, the worse the drawdowns will become, and the more painful the final reckoning will be.

Weighed, and found wanting.

Stand and deliver.

Category:

comex warehouse,

German Gold,

Gold ETF Drawdowns

Gold Daily and Silver Weekly Charts - Ship of Fools

"No offense to those mad geniuses of Greece,

But wisdom is never perfect here below;

Folly is found in every age we know,

Even careful fools differ, but only in their ebb and flow."

Nicolas Boileau-Despreaux, Satires

tr. by Jesse

There was very little activity in the Comex warehouses on Friday as about 16 bullion bars left the Scotia Mocatta customer category.

HSBC has been added to the firms that are being investigated for the rigging in the foreign exchange markets.

Isn't it wonderful how just about every market has been found to be subject to clumsy rigging by the banks, EXCEPT the gold and silver markets?

Gold and silver were capped most of the day, for the usual reasons no doubt.

The gold in particular continues to flow from West to East. How long can it last? One thing is almost certain, that this will not end well.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - A Tipping Canoe and Twitter Too

Tomorrow is the ISM Services, but on Wednesday we will see the unemployment claims, Challenger job cuts, and Advance GDP for Q3.

The jobs related data takes on some importance because we will be getting the October Non-Farm Payrolls report on Friday, along with Personal Income and Spending, and the Michigan Sentiment reading for November.

Twitter IPO looms and today we hear that the price of the IPO is getting kicked higher because it is 'sold out.'

There is an interesting dynamic going on here with the Twitter IPO. There is of course a desire for the principals not to leave too much on the table with a lowball offering price. But at the same time they do not wish to price too aggressively and end up with an embarrassment like Facebook had been.

The gaming going on for those being granted shares is quite heated I hear, and there is some desire to ramp the price after the offering comes to market, in order for the flippers to cash in over the following two or three weeks with a healthy profit. The stock market will have its year end wind at their backs.

So you see how that dynamic is setting up. The company does need the cash, since they have little cash flow of their own, so pricing higher is a definite plus.

And over this web of intrigue and varied interest hovers the mighty vampire quid, Goldman Sachs.

I have a feeling that this one is going to signal a high water mark of some sort, exactly what I am not yet sure.

Have a pleasant evening.

Subscribe to:

Comments (Atom)