08 November 2013

Non-Farm Payrolls Report - Small Business Creation Boomed In October

Did new small business jobs creation boom in October during the government shutdown/default crisis?

Well, you might think so by looking at the Bureau of Labor Statistics 'Birth-Death' model report contained in today's October Non-Farm Payrolls Report.

According to the Birth Death Adjustment there were 126,000 jobs added in October. And what an October it was apparently. These are the most new jobs added for any October going back to 2003, which is as far back as my own spreadsheet goes.

A more usual number might be around 103,000 or less. So, someone thinks it was a strong October jobs market.

You can look at the historical Birth-Death Model numbers from 2000-2012 here. And there is a list of Frequently Asked Questions here.

As I have cautioned in the past, the Birth Death number is added to the Non-Seasonally adjusted number, and then seasonally adjusted. So it is not a 'pure addition.'

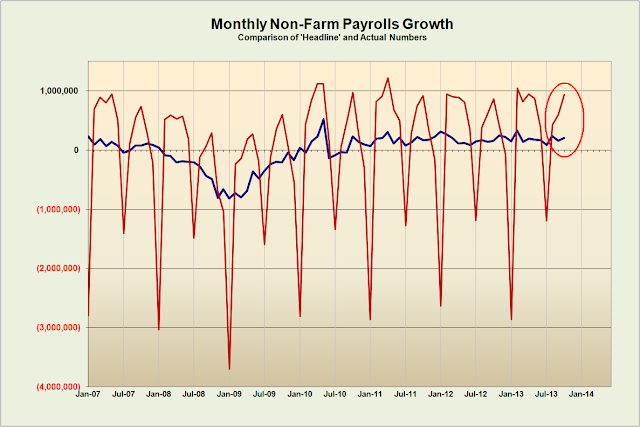

The Non-Farm Payrolls report contains very large numbers, on the order of 137+ million jobs which are estimated and deseasonalized, and then further revised for the next two months. So reacting strongly to a particular monthly jobs report is a bit of a Wall Street and political game.

What is more important is the trend in the number of jobs, and the quality of the jobs, both in hours worked and hourly compensation.

Another statistics worth noting is the Labor Force Participation Rate. There is a fairly good commentary on that data from this Payrolls report here. There was a similar issue with the Households Report since it dealt with the layoffs from the government shutdown differently than the headline NFP report.

As an aside, when I hear some financier talking about 'the new normal,' as they were on financial television today, it makes me want to gag. They are attempting to justify the results of their fraud and financial repression as a necessity, just business as usual. There is nothing 'normal' about this current economic environment. We are in a financialized society where big money dominates public policy for its own ends.

Getting back to the Non-Farm Payrolls number, the big hoohah question is always, 'Is the government lying?' I think it is fair to say that they are certainly putting their best foot forward, in this and quite a number of things.

I am a little more concerned about the lies that take the US into wars of aggression to be frank. But economic deception can have very bad long term effects when coupled with bad economic policy decisions such as those we are seeing today, that are propagating and even increasing an inherently unstable economy.

All things considered, and not just the numbers in this report, the recovery is weak, and real median wages do not support any sustainable recovery. Inequity is increasing, and policy supports and subsidizes this growing inequality in both political and economic power.

Keep an eye on the real median wage, and you will have some indication on how the American public is faring. Although the calculation of inflation is fraught with the fog of politics. John Williams of Shadowstats has done some excellent work in this area.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

And that is the bottom line.

In this case the smaller the seasonality factor the bigger the jobs increase because the raw number is being divided by and reduced in September and October to arrive at the seasonal adjustment. But there are so many estimates involved that the answer really lies in the trends and even more importantly the quality of the jobs.

Category:

median wage,

Non-farm Payrolls

07 November 2013

Gold Daily and Silver Weekly Charts - ECB Surprise Cut, Non-Farm Payrolls Tomorrow

The metals caught the patented Comex open price hit and pretty much drifted around there all day.

Molto Mario Draghi cut the ECB rate. There was fleeting joy in Mudville.

Did we mention that tomorrow is a Non-Farm Payrolls number? 100K is the consensus.

There was a withdrawal of 1,700 gold bullion ounces out of the Brink's Registered category. That is a remarkably round number., and a deposit of 19,688 ounces of gold in to storage at JPMorgan Chase.

Let's see how the metals finish the week. The next big Comex event will be the December options expiration on Monday, 25 November.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - A Post Twitter Market Commences

Twitter came out this morning, to cheers and jubilation at around 45, ticked as high as 50 intraday, and then closed slightly below the open at about 44 and change.

The rest of the market dumped off, in a somewhat cynically amusing manner, despite a 'better than expected' GDP number.

It was like the Twitter IPO sucked all that fast 'liquidity' out of the market, and tech stocks in particular dropped in the vacuum it created. Momentum is fleeting.

Tomorrow we get the Non-Farm Payrolls number. Consensus if for an add of 100K. I would not even care to hazard a guess.

It comes down to how they handle the 'government shutdown.'

Have a pleasant evening.

Subscribe to:

Comments (Atom)