08 November 2013

Gold Daily and Silver Weekly Charts - 'Claims Per Deliverable Ounce' Rises to Record High 60.38

As you probably know the US posted a blowout headline number for the October Non-Farm Payrolls report of 204,000 jobs gains, and upwardly revised the prior month. What made this significant was the thinking that the government shutdown would have negatively impacted the jobs number.

That was not to be, not that it didn't impact jobs, but it did not impact the way in which the government counted jobs in what is the headline, 'establishment' report. The 'Household Report,' which is based on a direct survey of people, and the Labor Participation Rate which compares people who are working versus those who are available for work, were in the tank. Some other aspects like wages and hours worked were not looking very good either.

There was intraday commentary on the Non-Farm Payrolls Report here.

But hey, Wall Street was happy, with both stocks and the dollar rallying, and the SP and DJIA reaching new all time highs. Naturally in keeping with Non-Farm Payroll tradition gold and silver were hit hard, and not all that subtly. The reason for this was that the great jobs number would bring out the Fed taper talk again, but not for stocks, which were just frothing. Except of course for Twitter which had its frothy moment yesterday.

The 'claims per deliverable ounce' for gold on the Comex rose to an all time high of 60.38 contracts per ounce said to be in their warehouses and available for delivery. There was very little action in or out of the Comex gold warehouses yesterday. They are the pretty magician's assistance on the stage. The real action is taking place behind the screens.

Most of the commentary from the US financial media was funny, but in a very sad sort of way.

Let's see how the delivery process for gold plays out into year end.

Have a pleasant evening.

Non-Farm Payrolls Report - Small Business Creation Boomed In October

Did new small business jobs creation boom in October during the government shutdown/default crisis?

Well, you might think so by looking at the Bureau of Labor Statistics 'Birth-Death' model report contained in today's October Non-Farm Payrolls Report.

According to the Birth Death Adjustment there were 126,000 jobs added in October. And what an October it was apparently. These are the most new jobs added for any October going back to 2003, which is as far back as my own spreadsheet goes.

A more usual number might be around 103,000 or less. So, someone thinks it was a strong October jobs market.

You can look at the historical Birth-Death Model numbers from 2000-2012 here. And there is a list of Frequently Asked Questions here.

As I have cautioned in the past, the Birth Death number is added to the Non-Seasonally adjusted number, and then seasonally adjusted. So it is not a 'pure addition.'

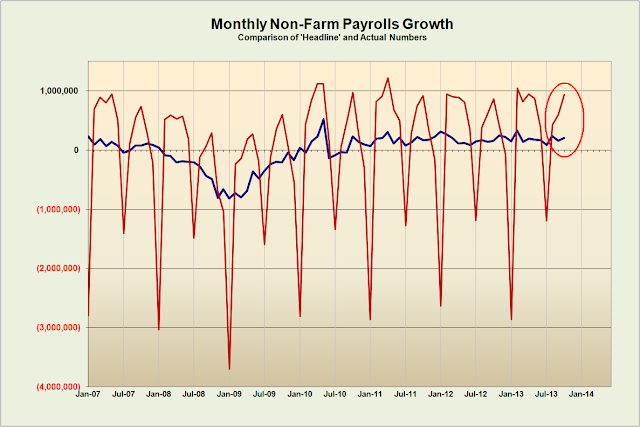

The Non-Farm Payrolls report contains very large numbers, on the order of 137+ million jobs which are estimated and deseasonalized, and then further revised for the next two months. So reacting strongly to a particular monthly jobs report is a bit of a Wall Street and political game.

What is more important is the trend in the number of jobs, and the quality of the jobs, both in hours worked and hourly compensation.

Another statistics worth noting is the Labor Force Participation Rate. There is a fairly good commentary on that data from this Payrolls report here. There was a similar issue with the Households Report since it dealt with the layoffs from the government shutdown differently than the headline NFP report.

As an aside, when I hear some financier talking about 'the new normal,' as they were on financial television today, it makes me want to gag. They are attempting to justify the results of their fraud and financial repression as a necessity, just business as usual. There is nothing 'normal' about this current economic environment. We are in a financialized society where big money dominates public policy for its own ends.

Getting back to the Non-Farm Payrolls number, the big hoohah question is always, 'Is the government lying?' I think it is fair to say that they are certainly putting their best foot forward, in this and quite a number of things.

I am a little more concerned about the lies that take the US into wars of aggression to be frank. But economic deception can have very bad long term effects when coupled with bad economic policy decisions such as those we are seeing today, that are propagating and even increasing an inherently unstable economy.

All things considered, and not just the numbers in this report, the recovery is weak, and real median wages do not support any sustainable recovery. Inequity is increasing, and policy supports and subsidizes this growing inequality in both political and economic power.

Keep an eye on the real median wage, and you will have some indication on how the American public is faring. Although the calculation of inflation is fraught with the fog of politics. John Williams of Shadowstats has done some excellent work in this area.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

And that is the bottom line.

In this case the smaller the seasonality factor the bigger the jobs increase because the raw number is being divided by and reduced in September and October to arrive at the seasonal adjustment. But there are so many estimates involved that the answer really lies in the trends and even more importantly the quality of the jobs.

Category:

median wage,

Non-farm Payrolls

Subscribe to:

Comments (Atom)