"He who does not punish evil commands that it be done."

Leonardo da Vinci

I believe that this example of how the Fed and the US government 'directed' gold to preferred parties prior to a major revaluation is even more relevant now than I did when I first wrote about this in 2009.

As you know, I think that a new 'Bretton Woods' will be reconstituted at some point, and what we are seeing right now is a vigorous 'negotiation of terms' between the Anglo-American banking cartel and the developing countries, or at least those that cannot be cowed by force. The wild card is why China has been included so graciously and so deeply in the scheme, and what role they are expected to play.

This has been referred to here and other places for some time now as the 'currency war.'

There is plenty of propaganda, also known as semi-official 'advice,' being put forward in support of the various intentions of the worldly powers. China is clearly urging its people to buy gold for themselves, and the West is encouraging its people to turn their gold over to the Banks. To expect China to act in the interest of the Western peoples is a bit too altruistic to be credible.

And while I do not expect a 'hard confiscation' of gold and silver, given the likelihood of credible resistance at least in the States, I do think that expecting a 'bail-in' to occur, even from so-called

allocated assets in storage in a few countries in the Banks' sphere of influence, from the US and the UK to their former colonies and client states, to be increasingly possible.

If this is correct, then the public of America and the UK, not to mention Europe and Japan, may be in for what is colloquially referred to as 'a royal screwing.' That is so dark that it seems to be almost impossible, inhuman. It would be taking money from innocent people, especially the poor and the weak, to bailout the Banks and the thoroughly corrupt monied interests. But based on what we have seen, it is certainly not out of the question.

Let's see how all this plays out.

The Last Time the Feds Devalued the Dollar to Save the Banks

14 January 2009

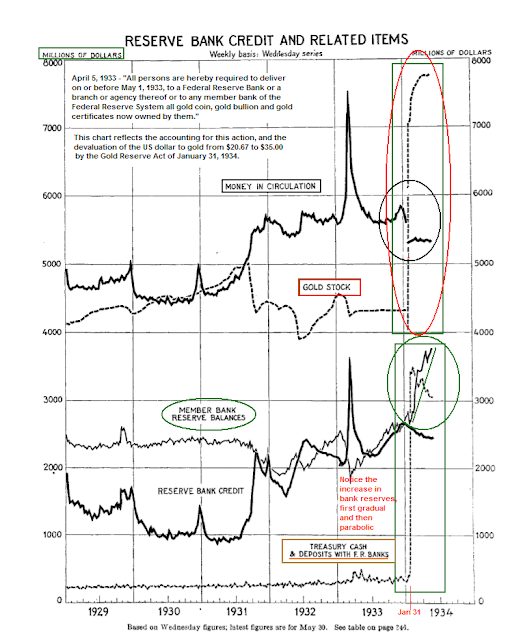

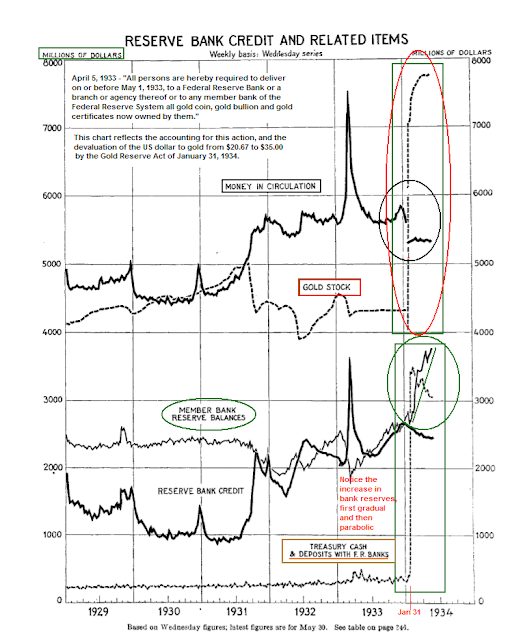

We dipped once again into the Federal Reserve Bulletin Publication from June, 1934 to take a closer look at the growth of the monetary base, and found an interesting graphic that shows the accounting for the January 1934 devaluation of the dollar and the subsequent result on Bank Reserves in the Federal Reserve System.

As you will recall, the Gold Act, or more properly Executive Order 6102 of April 5, 1933, required Americans to surrender their gold coinage and certificates to the Federal Reserve Banks by May 1, 1933. There were no prosecutions for non-compliance except one benchmark case which was brought voluntarily by a person who wished to challenge the act in court.

After a substantial portion of the gold was turned in by US citizens and taken from their bank based safe deposit boxes, the government officially devalued the dollar from 20.67 to 35.00 per ounce in the Gold Reserve Act of January 31, 1934.

The proceeds from this devaluation were used to provide a significant boost to the Federal Reserve member bank positions as shown in the first chart below.

The inflation visited on the American people because of this action helped to take the CPI as it was then measured up 1200 basis points from about -8% to +4% by the end of 1933. To somewhat offset the monetary inflation the Fed also contracted the Monetary Base which served the nascent recovery in the real economy rather poorly and is viewed widely as one of a series of policy errors.

Considering that the actions did little for the employment situation this was painful medicine indeed to those who were dependent on wages.

Fortunately at the same time FDR was initiating the New Deal programs which, despite continual opposition from a Republican minority in Congress, managed to provide a small measure of relief for the 20+% public that was suffering from unemployment and wage stagnation.

People ask frequently "Will the government seize gold again?"

While there is no certainty involved in anything if a government begins to overturn the law and seize private property, one has to ask for the context and details first to understand what happened and why, to understand the precedent.

Technically, the government did not engage in a pure seize of private property, since at that time the US was on the gold standard, and much of the gold holdings of US citizens were in the form of gold coinage and certificates.

Governments always make the case that the currency is their property and that the user is merely holding it as a medium of exchange. The foundation of the argument was that the government required to recall its gold to strengthen the backing of the US dollar against the net outflows of gold for international trade. The devaluation helped with this as well, since dollars brought less gold for trade balances.

People also ask, "Why didn't the government just revalue the dollar without trying to recall all the gold from the American public?"

The answer would seem to be that this would have been more just, more equitable recompense for the public. The Treasury could have purchased gold from the public to support its foreign trade needs.

But it would have left much less liquidity for the banks.

One can make a better case that the recall of the gold, with the subsequent revaluation to benefit a small segment of the population in the Banks, was a form of seizure of wealth without due compensation. Hence the lack of active prosecutions.

So, will the government take back gold again to save the banks by devaluing the dollar?

Highly unlikely, because they not only do not need to this, since the dollar is no longer backed by gold, and is a form of secular property except perhaps for gold eagles, but they do not have to, because they are devaluing the dollar already to save the banks.

This time the confiscation of wealth to save the banks is called TARP. (And QE I&II, financial asset inflation, and gold leasing and suppression with the soft confiscation of price manipulation. - Jess).

If one thinks about it, US Dollars are being created and provided directly to the banks to boost their free reserves significantly, at a scale comparable and beyond to 1933-34.

The confiscation of wealth is being spread among all holders of US dollars and dollar assets, foreign and domestic, in the more subtle form of monetary inflation.

Granted, the government must be more opaque to mask their actions in order to sustain confidence in the dollar while the devaluation occurs, but this is exactly what is happening, and all that is required to happen in a fiat regime.

There is no need to seize widely held exogenous commodities like gold and oil, but merely dampen any bellwether signals that a significant devaluation of the dollar is once gain being perpetrated on the American people in order to save the banks.

Its fascinating to look carefully at this next chart below.

First, notice the big drop in gold in circulation of 9.8 million ounces, or roughly 36% of the measured inventory at the end of 1932. Think someone was front-running the dollar devaluation? We suspect that the order went out to start pulling in the gold stock to the banks.

The reduction in gold in circulation AFTER the announcement of the Gold Act in April would be about 3.9 million ounces, or roughly 22% of the gold remaining in circulation in March 1933.

Considering that all gold coinage held by banks in the vaults was automatically seized, the voluntary compliance rate is not all that impressive. We are not sure how much of this was being held in overseas hands by non-US entities.

But beyond a doubt, there was an unjust, if not illegal, seizure of wealth by requiring citizen to turn in their gold to the banks, which was then revalued at the beginning of 1934 by 69% from 20.67 to 35 dollars.

It would have been much more equitable to devalue the dollar and to change the basis for dollar/gold first, before requiring private citizens to surrender their holdings. But of course, this would have lessened the liquidity available for direct infusion into the Federal Reserve banks.