There were a few notable changes in the Comex gold warehouse inventory yesterday, as 146,000 ounces of gold had their warrants cancelled and were adjusted from 'registered' to 'eligible.'

What is particularly interesting about this is that it knocked the deliverables down back down to 600,000 ounces, with almost half of those held by Scotia Mocatta.

It would certainly be interesting if we knew exactly who held what, and what their net positions might be. And it would certainly be fun if I knew everything I want to know, and had everything I want to have. But life is a struggle to find out how things work, and it is especially hard to discover what has been hidden for whatever reason.

There is another interesting chart that Nick and I produced that shows what JPM stopped and issued in terms of Comex gold contracts over the past twelve months. As you will recall when a party 'stops' a warrant they are taking delivery, and when they issue a warrant they are offering gold for sale.

I don't think this sorts out what JPM is doing for its house account versus what they are doing overall as a bullion bank. I may take a crack at that later on.

So obviously some of this is just pure correlation with what customers are doing, ie. selling on price declines, and then buying bottoms and riding it back up.

What is interesting is the huge spike in year end buying (stopping) of contracts that has not yet been reflected in price. I am watching this with care, because as you may remember we have seen these big dips in registered inventory signal an intermediate price change within six months, at least within the last ten years of this bull market.

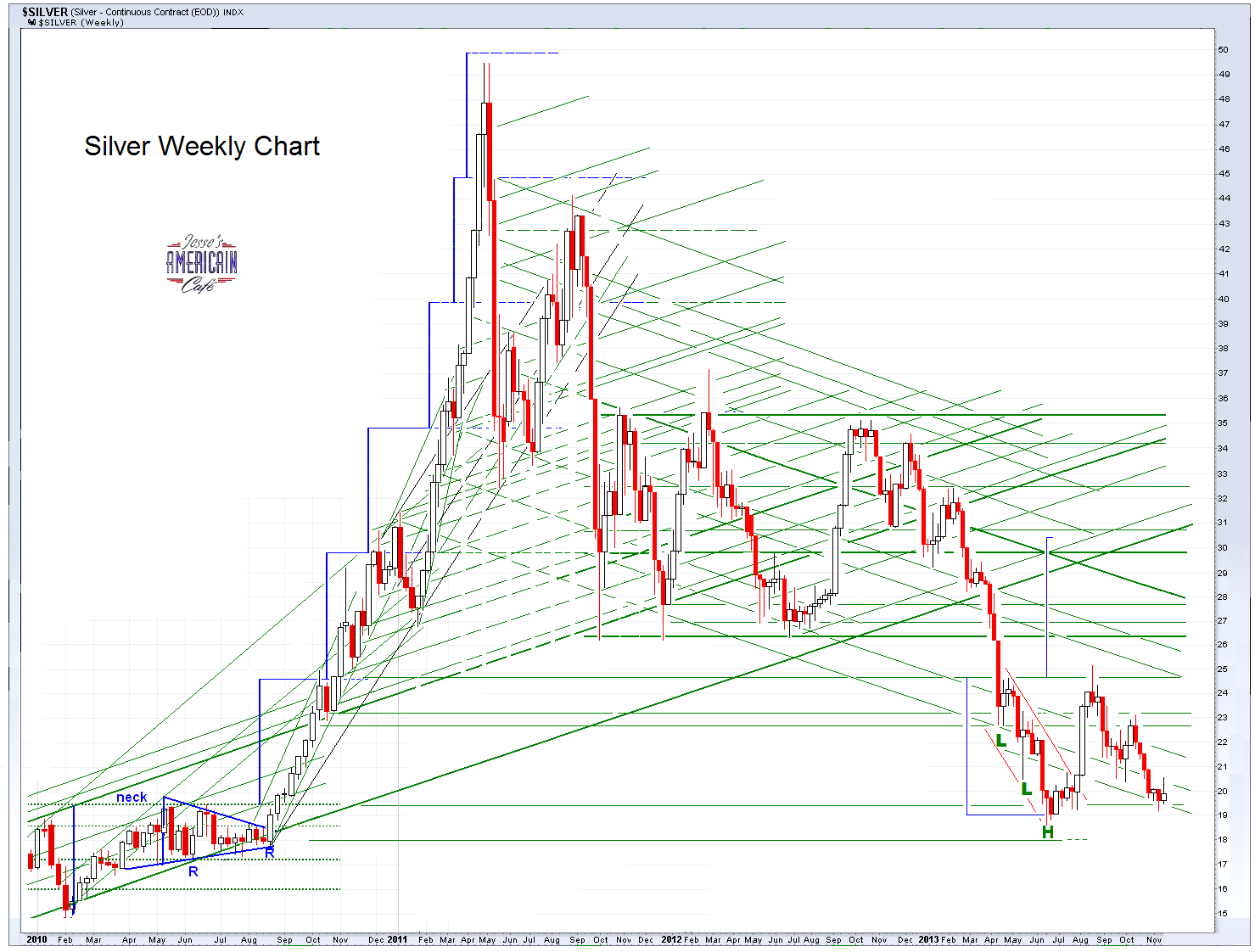

I know quite a few people are getting edgy on this correction and I can't blame them for that. But that does not mean that someone is going to be able to tell them with high certainty that the market has bottomed and the correction is over so that they can immediately rush out and put in leveraged bull bets and make a fortune.

There are those who will tell you that, many, many times in fact, almost every other week it seems. And when and if a turn does come, they will point to that 'call' and say see I was right, and forget about the ninety other times they were wrong.

It does not work like that. We will get a confirmation if we get a trend change, and you *might* miss the first ten percent of the up move by waiting. But you will also miss a lot of wear and tear on yourself and your portfolio in the process. Most traders who sell the top and buy the bottom with precision are either darn lucky or damn liars. At least that is what Bernard Baruch says and my own experience tends to validate that.

I do think we are in a bottoming process and the emphasis here is on

process. If we are holding positions without leverage and a longer term time horizon, what difference does it make if the trend change comes next week or next month or even five months from now? What is important are the fundamentals and the trend.

I do have both a long term and a short term portfolio. The long term I have not touched in some years. The short term has been adjusted to match my thoughts on the current market structure, a little more aggressively than normal perhaps.

I have modified my thinking about Comex a bit, now seeing how much of an insiders' shell game it has become because of the laxity over positions and price antics, and the high amount of paper shuffling and opaque positioning that occurs relative to how much actual clearing of markets between producers and buyers is accomplished. But it is what it is: a speculative vehicle. And its role in world markets is changing, diminishing most likely.

Have a pleasant weekend.