There was some intraday commentary

that I will recommend for your reading:

Where We Are At in the Global Precious Metals Markets - A Framework.

It is a short summary of what I think is driving the precious metals market, particularly gold, but certainly including silver. It seeks to include quite a number of events over the past twenty years that may not make sense in isolation, but certainly can come together as an understandable whole in some framework such as the one which I propose. There are certainly others.

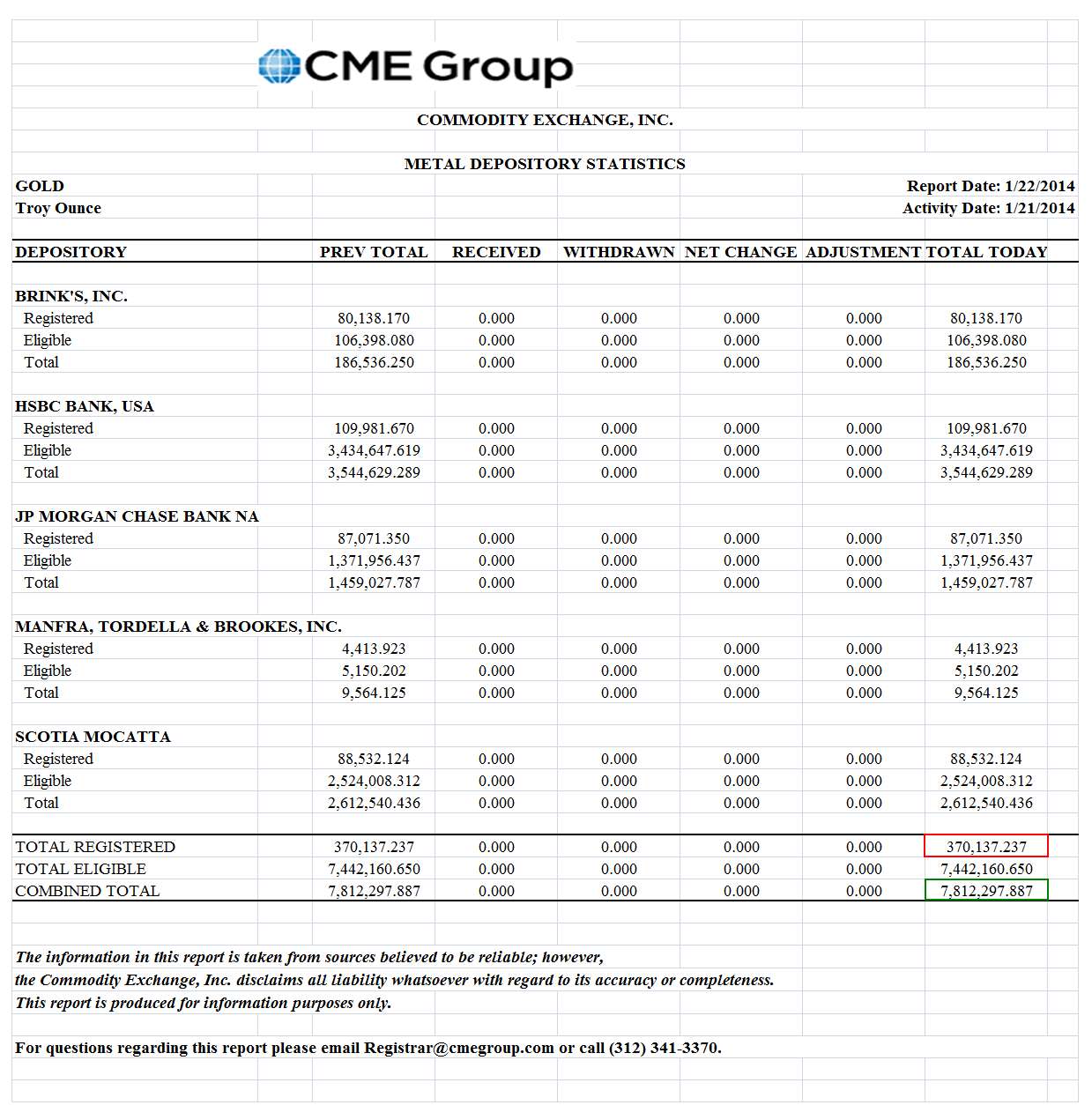

There was no movement in or out of the Comex gold warehouses yesterday.

I have to specially thank Grant Williams for the kind words which he had for Le Café in his newsletter,

Things that Make You Go Hmmmm.

"Well, one of the most respected names in the bullion markets is that of Arthur Cutten, proprietor of Jesse's Café Américain (if you follow gold and silver but don't have that page bookmarked, I'd recommend you do so right now.) In a post he wrote in March 2010, Arthur asked a pertinent question [about AIG]"

It is nice to be recognized for something you care about from someone whom you respect.

I showed this to

she-who-must-be-obeyed, and in response she recounted some of her favorite excerpts from

His Mistakes and Shortcomings in six volumes which she has maintained over the past 41 years.

Many of them are sins of omission, according to her judgement, and 'stupid things all men say and do' for which I therefore am not personally responsible. But alas, the rest are spot on.

So I can assure you such effusive compliments will not go to my head.

But I may have a Manhattan tonight as a personal bonus for having done something right. And besides, its my 62

nd birthday, and it's the little things that make life worth living.

The Dude abides.

Have a pleasant evening.