"The only way to partially explain away why JPM has been allowed to hold such controlling market shares [in gold and silver] is to claim that JPM is either hedging for clients or making markets. But in flipping from a 20% short gold market corner in Dec 2012 to a 20% long market corner 8 months later, the hedging argument goes out the window as it is impossible to reconcile what clients would be shorting so much in December and being long so much 8 months later. Remember, JPMorgan tried the same hedging excuse when the London Whale debacle was first reported, but dropped it immediately when it became obvious that it was nonsense. That leaves market making...

Market making is permitted and encouraged to enhance liquidity and tamp down price volatility, but not to rig prices...If JPMorgan is practicing market making in silver they couldn’t be doing a poorer job..."

Ted Butler, Butler Research LLC, Feb 12, 2014

"If you shut up truth and bury it under the ground, it will but grow, and gather to itself such explosive power that the day it bursts through it will blow up everything in its way."

Emile Zola

I think the whole matter of silver manipulation could have been cleared up if the CFTC had actually released the finding of their five year investigation into manipulation of that market, and stated that they had looked at the hedging and market making closely, found it to be legitimate, and backed it up with some verifiable and conclusive facts.

But they chose instead to say nothing. The lack of transparency in the financial system overall is harming confidence, and is morally appalling.

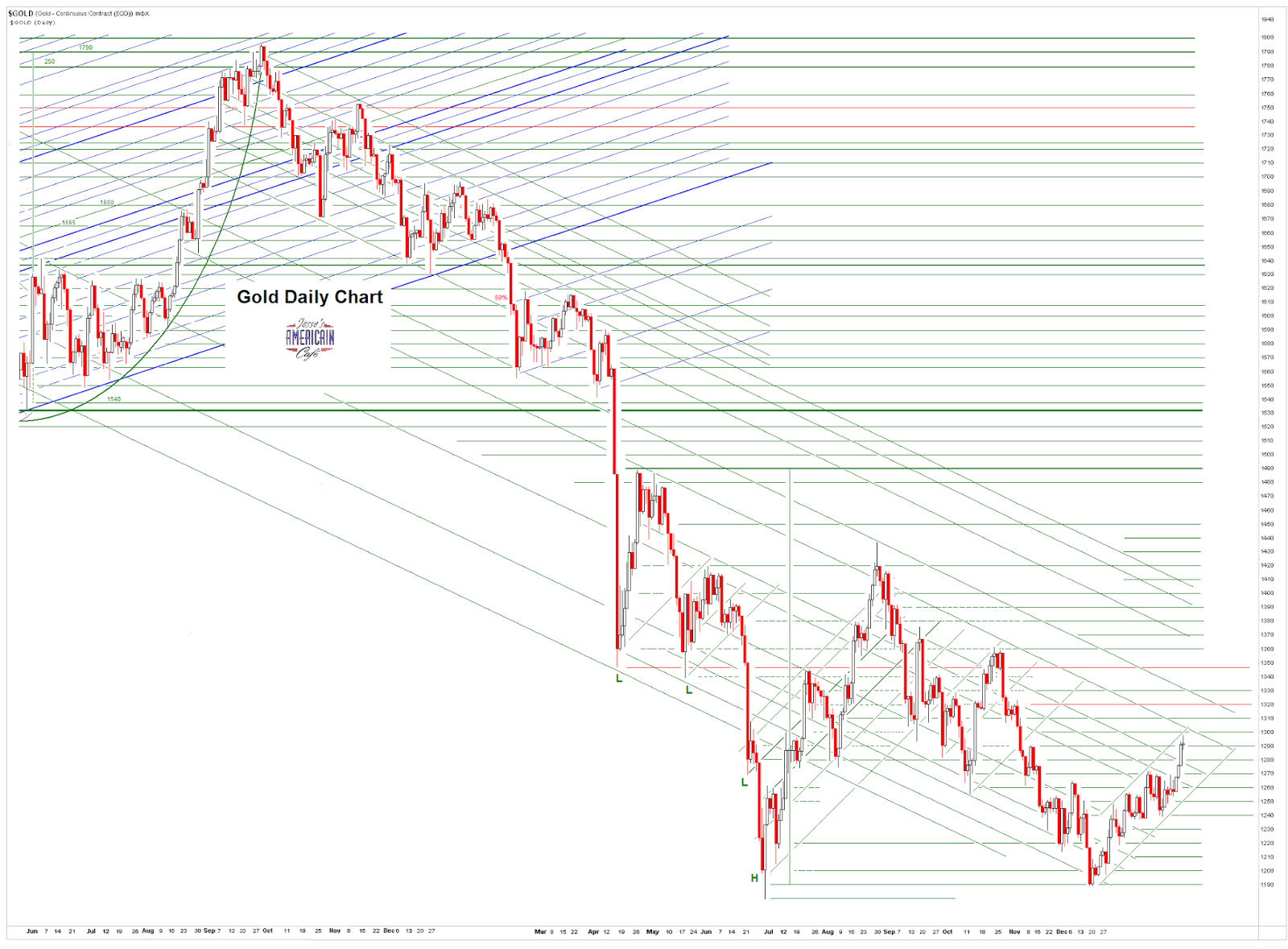

The precious metal cartel is giving up ground, but grudgingly. We will know that they are defeated when we see them running for their lives, ahead of what is likely to be a memorable break in the paper gold and silver markets.

I do not expect the big insiders to get caught up in this debacle as I have said on numerous occasions. But they will be carrying some big specs and funds out on stretchers. And perhaps a bureaucrat, politician, and banker or two.

In fact, it is likely that if the scheme is revealed and taken down

before a crisis, it will happen because big players started complaining to the regulators. The market overseers will listen to the financially powerful, if not the public, as had happened in the case of the London Whale. This is the failure of equal justice, and it will bring down whole governments if it continues.

The gold/silver ratio remains unusually high. The discounts on some of the funds are narrowing and the PSLV premium is getting wider. Their cash level is a bit low, leading one to assume they will once again add to their units in an offering probably later this year, but not too long into it.

They are trying to get through this February delivery period. March may be a different story perhaps. But at the end of the day there will be a reckoning, and the longer this continues the worse it will be.

No scheme such as this can go on forever, no matter how confident they may seem. The cockier they become, the closer the resolution. That is all a part of the bluff, and too often, self-delusion.