As a reminder, tomorrow is the option expiration for precious metals on the Comex, for the March contracts.

There was intraday commentary on

the Mad Tea Party at the Comex.

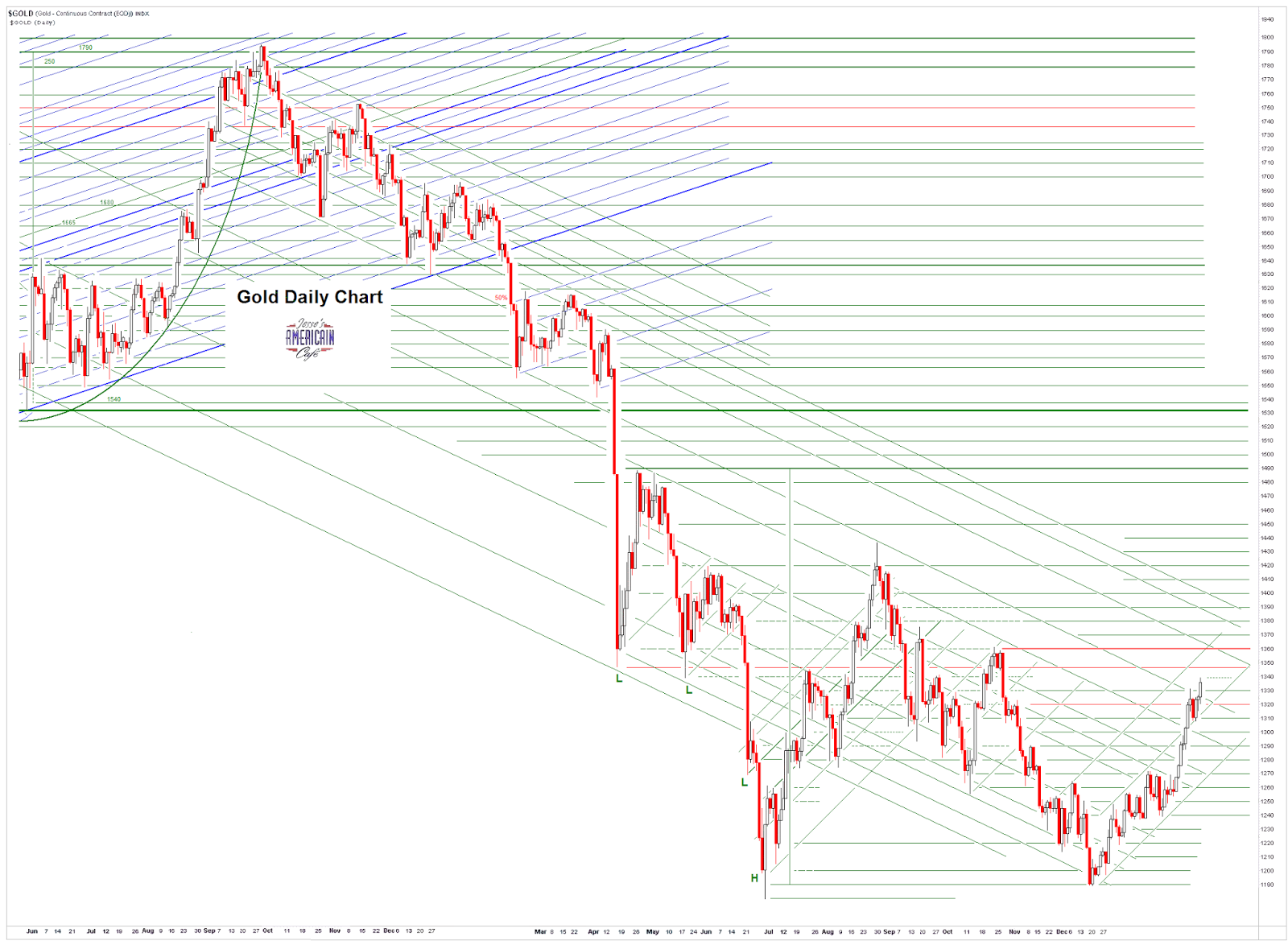

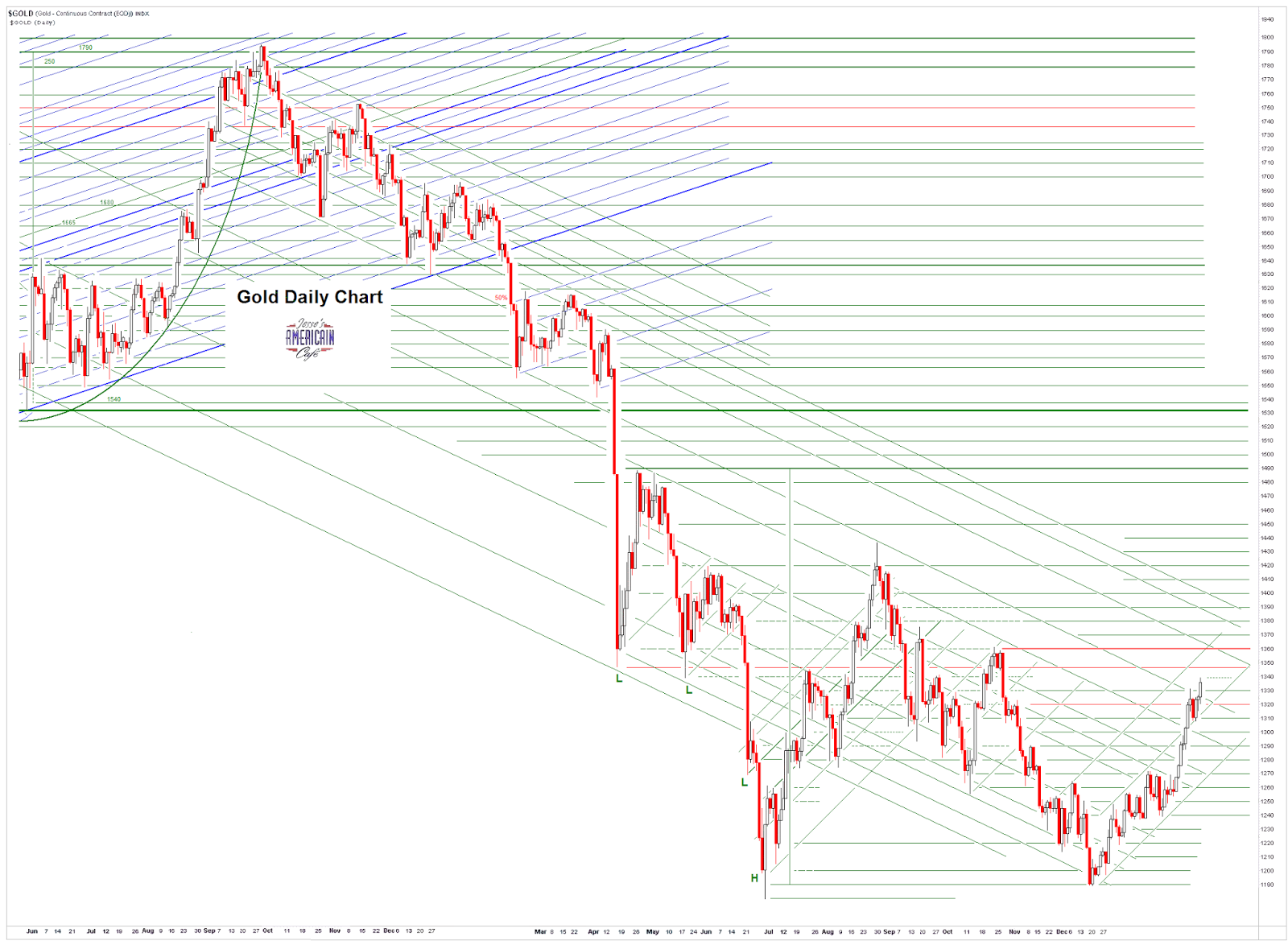

Gold has broken out of the short term downtrend, but has yet to take out the big overhead resistance on the chart below marked in red.

We have the smaller inverse head and shoulders working with a target that will activate the larger inverse head and shoulder, which forms the right portion of a huge 'W' double bottom.

So what does all that mean? Follow through to the upside is everything at this point. The wiseguys still have the whip hand on the Comex.

And the Comex is still playing a role in setting the price of the precious metals at least in the West.

The shorts are not quite on the run yet, and we may have to face some difficulties during the non-active delivery month of March.

The

Baghdad Bob's of the gold cartel are still out there talking their gloom and doom for the metals, and triumphantly asserting their demise.

But so far, so good. Let's see what happens.

Have a pleasant evening.