There was intraday commentary about a 'collapse in the international monetary system'

here. There are also some words about worrying too much to the point of near hysteria. Granted there are some things to watch closely and are cause for concern. The theory that a major sovereign currency cannot fail because it defines itself and its own value is not consistent with some of the things that we have seen happen with our own eyes..

It reminds me of the old story about a boxer who comes slowly to his corner between rounds. His manager encouragingly says, 'Don't worry, kid, he hasn't laid a glove on you.' And the boxer says, 'then you better have a talk with the referee, because someone is beating the hell out of me.'

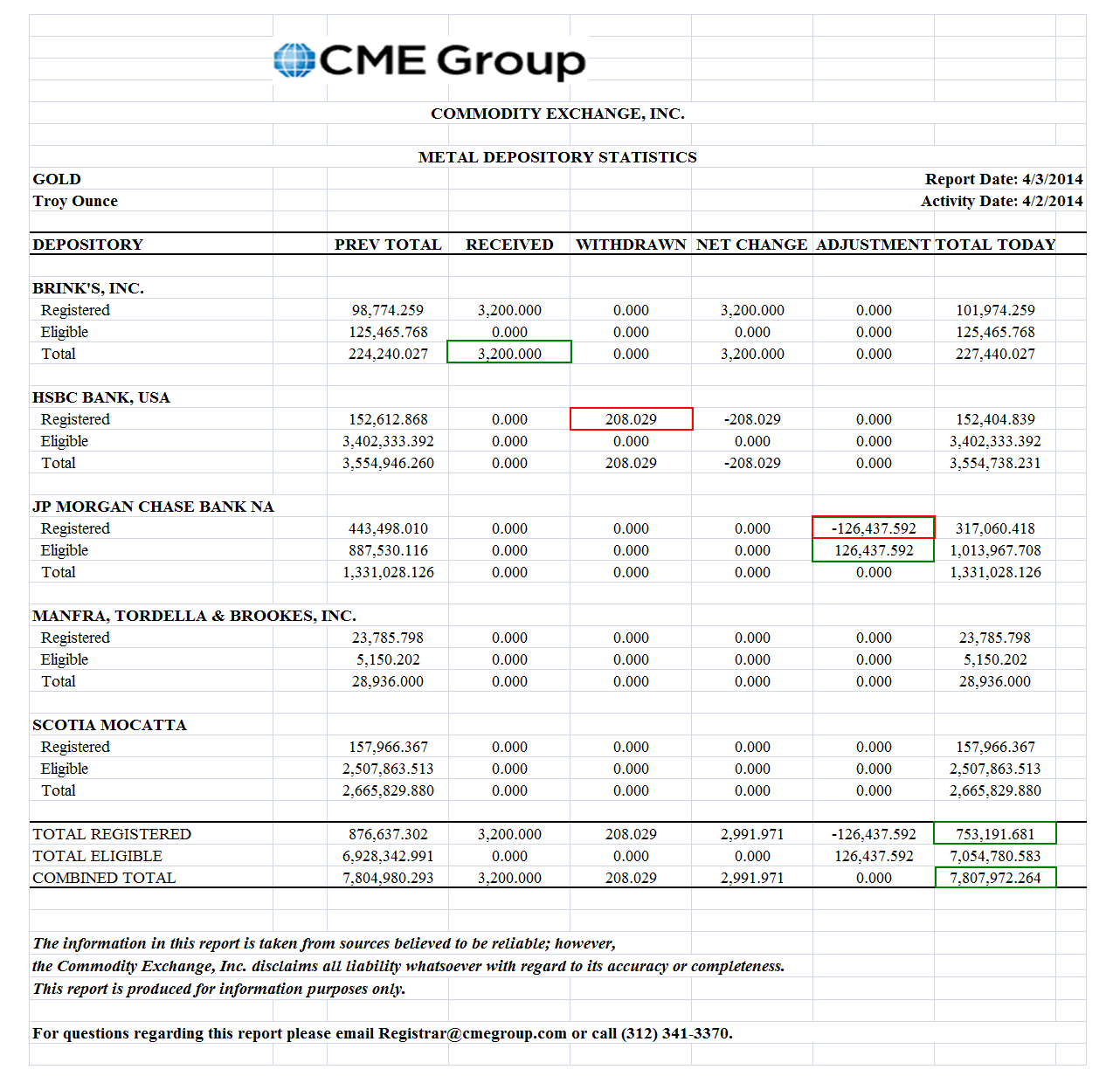

Someone asked me if all of the ounces of gold that are claimed in the futures clearing process are actually 'delivered,' and the answer as I have given it before is 'no.'

A party may stop or stand for a futures contract warrant, that is gold in the deliverable category, but that does not mean that they actually have to take that physical gold. They have other methods of settling in kind. And they may also 'take' that gold, but leave it where it is, depending on their intentions for it.

So I would take the clearing report as indicative, rather than the final word which is told by the warehouse stocks, with a lag. And I do not know if that sort of thing is still going on, but I recall a scandal where certain brokers were selling silver and charging storage for bullion that never really existed at allexcept on paper.

But I am sure that sort of thing does not happen anymore, and certainly not on the Comex. Who can imagine that major Banks and prestigious firm rigging prices and selling things that are not on the up and up. That is the talk of malcontents and those who do not give the system the proper amount of blind trust.

But it is a bit moot as I have more recently said. Precious metals and their trading are on the move from West to East. And the Comex is sometimes of the character of theater, where players move objects and money around to provide the appearance of reality, rather than the reality itself. One bigger change is that now one can also say that about the LBMA in London perhaps, with its hot potato trading and paper leverage to physical supply.

Have a pleasant evening.