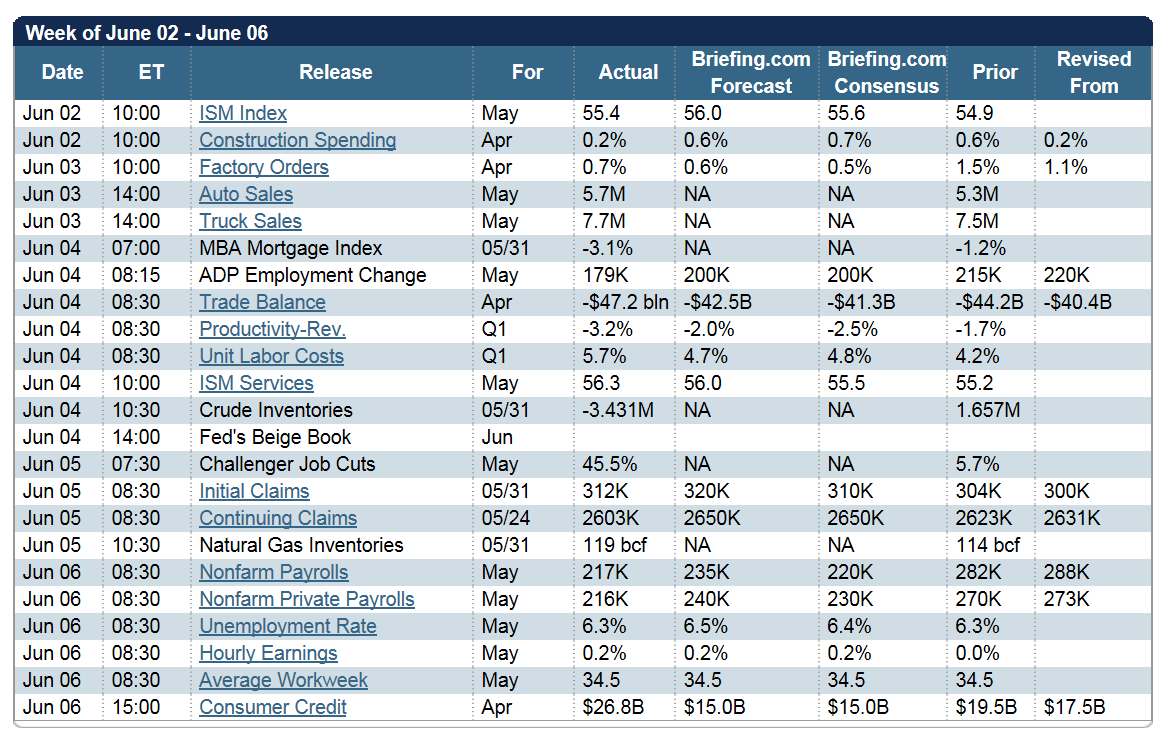

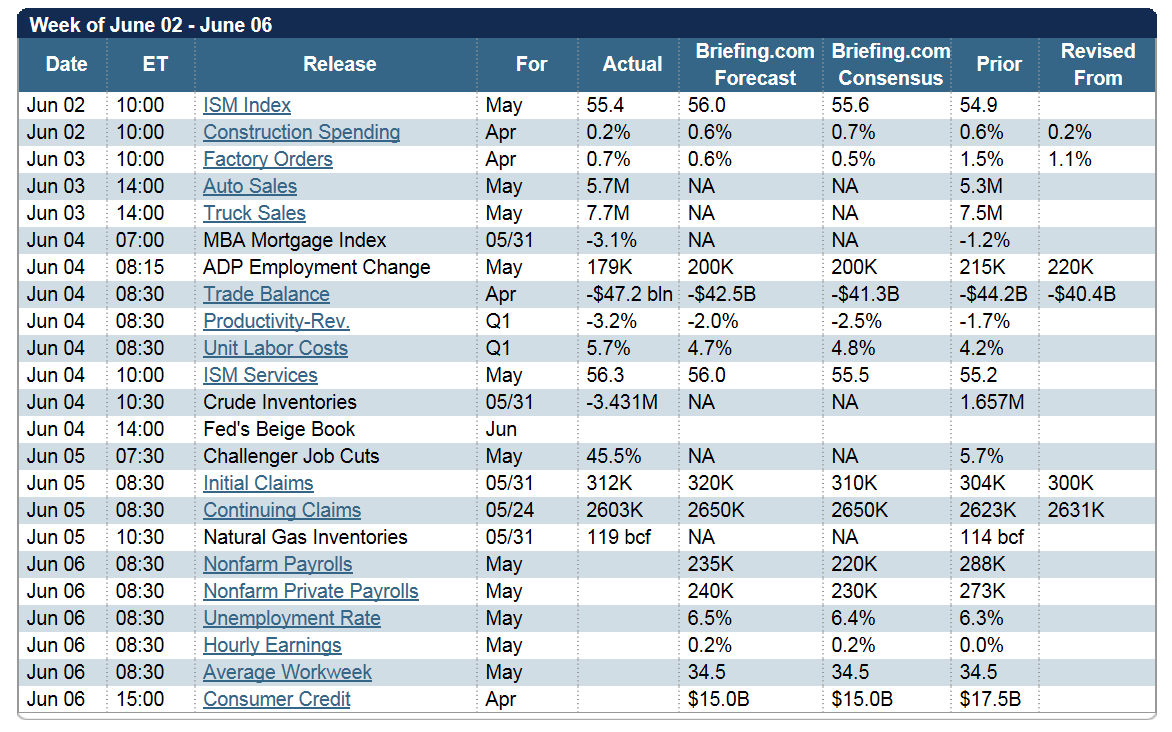

Non-Farm Payrolls came in a tad to the low side, but close enough to be considered 'in-line.'

Stocks continued to romp higher. The Russell 2000 and the broader market continue to lag a bit, but has finally returned to even money for the year. Chart below.

In a quiet market, absent any exogenous events, they can certainly keep whipping the market higher led by the SP 500 and NDX futures tag team.

The economic news is relatively lightweight next week with a few of the more important items near week's end.

It feels exactly as though we are already in the dog days of Summer. Since Alibaba is coming out on August 8th, we might well expect the market to muddle through until that beast can come forth, all things being equal.

It's not about the money; it's about the power. We make a desert, and call it peace.

Have a pleasant weekend.