10 June 2014

NAV Premiums of Certain Precious Metal Trusts and Funds

Very modest premiums to say the least.

I have taken a modest position in Silver Wheaton last week which is not normally commented upon here.

I am still anticipating another shelf offering in PSLV at some point to raise their cash levels back to more comfortable levels. But they are under no duress to do the deal given their existing levels which are adequate for their cash requirements, but are still a bit historically low.

Category:

NAV of precious metal funds

09 June 2014

Gold Daily and Silver Weeky Charts - Better Call Saul

There was little action on the metals front last Friday as the clearing and warehouse reports below demonstrate. The action has shifted to the East.

I expect the markets to unravel their story about the future somewhat slowly over the summer. This goes for stocks, bonds and commodities. We are seeing a great reckoning between reality and the will to power.

If anyone is near to a fiduciary responsibility for the obligations for gold and silver bullion delivery, or even large positions of naked shorts in stocks, and they do not personally have title and possession of the metal or the equities, I would probably suggest that they get out or start lawyering up now, with a well thought out Plan B involving offshore accounts and domiciles. You can always try for a Presidential pardon later on. I suspect it will become the fashionable thing to do.

If this convoluted system of asset rehypothecation starts breaking bad it is going to make MF Global look like a church picnic. 'Everyone was doing it' is not an unassailable defense, and 'I had no idea what was going on'' only works for those with very lofty connections and office.

Have a pleasant evening.

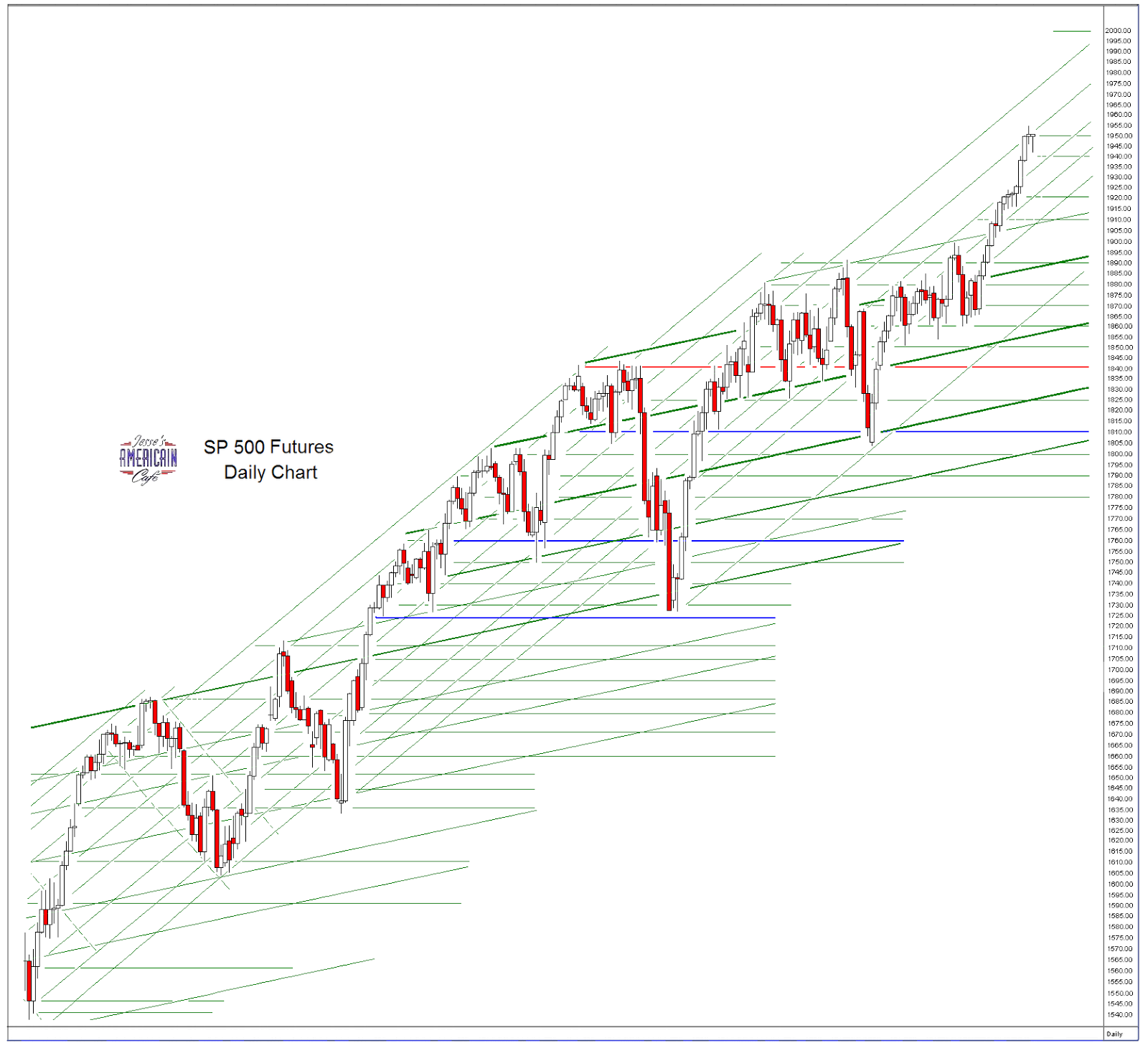

SP 500 and NDX Futures Daily Charts - Apple Splits 7-1, An Otherwise Sleepy Day

Apple's seven-for-one stock split took place today.

The split will allow Apple to take its message around the professionals and institutions directly to the retail investor who will now consider Apple 'more affordable.' It would also make it more palatable for that great stock Judas goat, the Dow Industrials average.

I figure the market will top out this summer, sometime around 2000 on the SP 500 futures or perhaps a bit of an overshoot. I don't know how long it will take to get there, and we may see a minor correction first. We are working off a funny kind of a stock formation that will lead to an unsustainable level unless it corrects back to the more sustainable trend.

This is barring any exogenous events which will tend to spin the market according to their own force. As the market reaches loftier levels ahead of the real economy, it becomes increasingly vulnerable, less robust. Or as Taleb might say more 'fragile.'

So we will see how it progresses, and will be able to determine if we are seeing a classic handoff of pumped up stocks to mom and pop near a top, or just an ongoing campaign by the Fed to inflate asset bubbles and reward their cronies with paper assets, while starving the real economy.

Have a pleasant evening.

Subscribe to:

Posts (Atom)