"Truth is truth, to the end of reckoning."

William Shakespeare, Measure for Measure

What goes down must generally go up, at least once in a while, especially when going down is fighting against the prevailing fundamental trend.

There was intraday commentary here about gold and silver that is worth reading if you have not done so already.

The downtrend is not yet over, but I am providing some clues as to those things that are worth watching. These include the gold/silver ratio, and the dow/gold ratio.

The short interest and market structure in silver provide a backdrop for some explosive upside movement IF the price can break out of the steady selling pattern which may have already gone to an extreme.

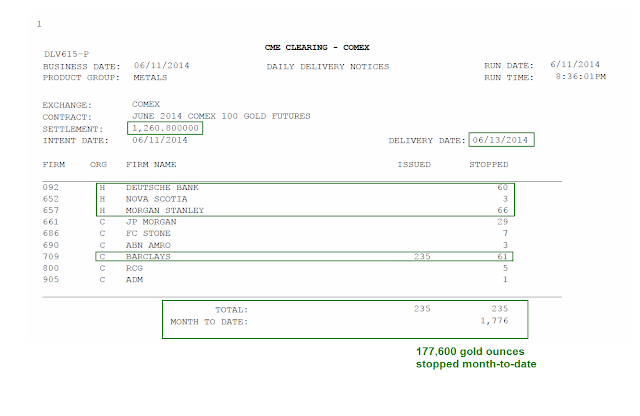

If there is a break in the market, you will not see it coming from anything on the Comex, which has become an extended infomercial for quite a bit of what is wrong in the US markets and economy: lack of transparency, captured regulators, weak enforcement, unequal protections, insider trading, and institutionalized frauds and inefficiencies.

It is difficult to draw any conclusions from the historic defeat of a major House of Representatives player in a primary, because of the exceptionally low voter turnout of less than 14%. And the overconfidence of the incumbent, Eric Cantor, going into the election certainly did not help to motivate his workers to get their base out to vote.

But having said that, it looks like this might be a reaction against an establishment politician who was widely perceived as a willing enabler of the financial corporations. We would have to see more elections like this to draw any meaningful conclusions however. As it is, people can use this one example to support just about any bias that they may wish to support.

It would be interesting to see a coalition of the dissatisfied start ousting incumbents, but there are many cultural divides to be breached for that to happen. Both sides, at their extremes, really cannot 'see' the other without scorn, stereotype, and derision. The center is a quiet place these days. But that is where the healing will begin.

Let's see what happens.

Have a pleasant evening.