"Wars can be prevented just as surely as they can be provoked, and we who fail to prevent them must share the guilt for the dead."Omar Bradley

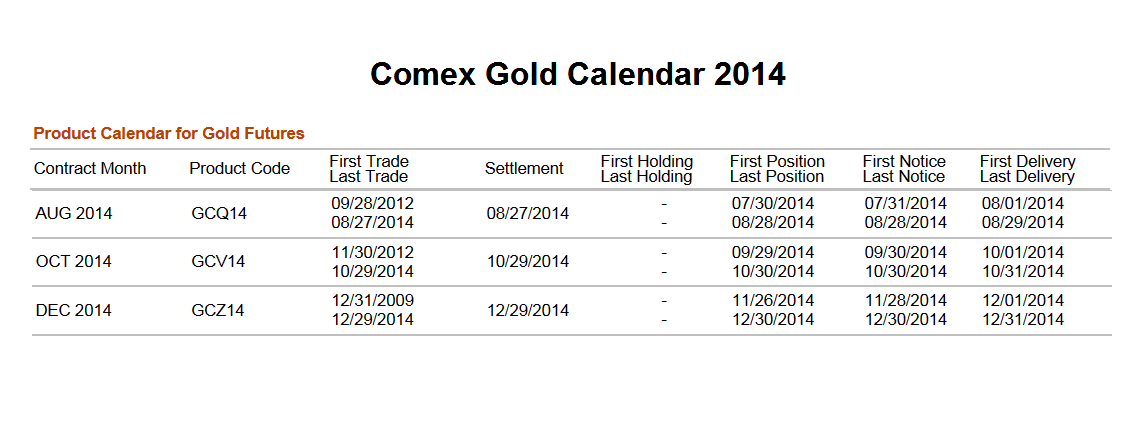

With tomorrow's trading the emphasis will likely shift from silver to gold as we move into the August contract period where gold is 'active' and silver is not.

Tomorrow brings the advance 2Q GDP number, and the results of a two day FOMC meeting in the afternoon.

Let's see how the metals make it through this gauntlet. And Non-Farm Payrolls on Friday.

Argentina may be forced into default tomorrow because of some fairly obtuse rulings by the fund friendly NY courts. The conversation about this on Bloomberg TV this morning was like something out of The Hunger Games.

The US has initiated even more sanctions on Russia. This does appear to be another manifestation of the currency war, engaged on a different level. It serves to distract and defer.

Have a pleasant evening.