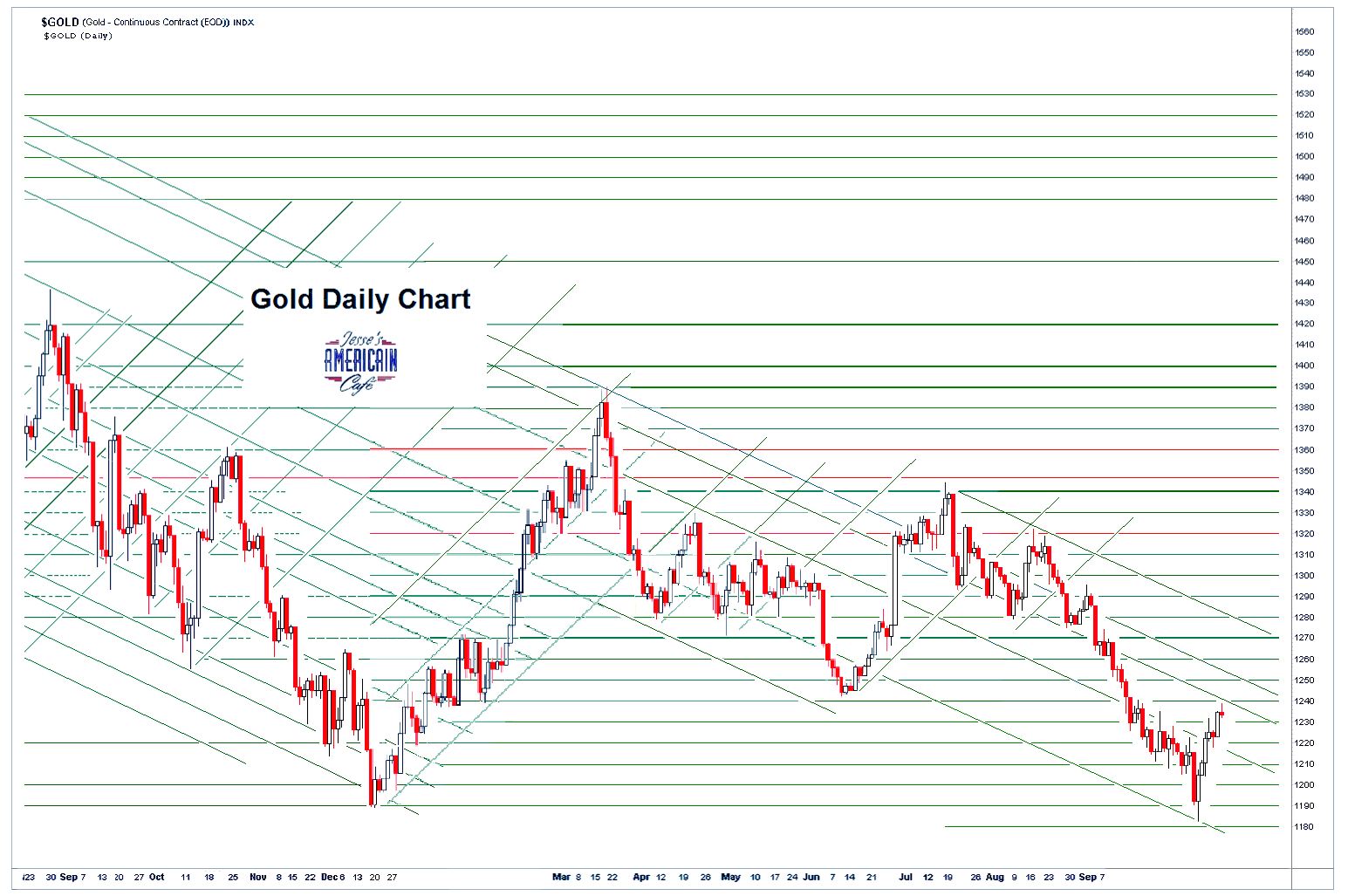

The timing is not exact but it is darn close. Depending on when you measure the actual first two bottoms it looks like about 1.65ish.

Dave from Cincinnati sent me a picture of the gold potential triple bottom with his Golden Ratio calipers and brought my attention to it.

This ratio is probably more familiar to those technical analysts who follow Fibonacci retracements which are related to the Golden Ratio.

This last bottom may have come about five or six days late at 1.618 perhaps. A valiant but failed effort perhaps to extend and pretend.

Close enough for government work.

I cannot account a trend change until we break the trend firmly of lower highs and lower lows. But there is no reason not to have a bit of fun while waiting to find out.