"Empires communicate in two languages. One language is expressed in imperatives. It is the language of command and force. This militarized language disdains human life and celebrates harshness and brutality. It demands. It makes no attempt to justify the flagrant theft of natural resources and wealth or the use of indiscriminate violence.

The other language of empire is softer. It employs the vocabulary of ideals and lofty goals and insists that the power of empire is noble and benevolent. The language of beneficence is used to speak to those outside the centers of death and pillage, those who have not yet been totally broken, those who still must be seduced to hand over power to predators.

The road traveled to total disempowerment, however, ends at the same place. It is the language used to get there that is different."

Chris Hedges

30 June 2015

Chris Hedges: A Prayer For Democracy - Town Hall Seattle

Category:

Chris Hedges,

Nec Laudibus Nec Timore

29 June 2015

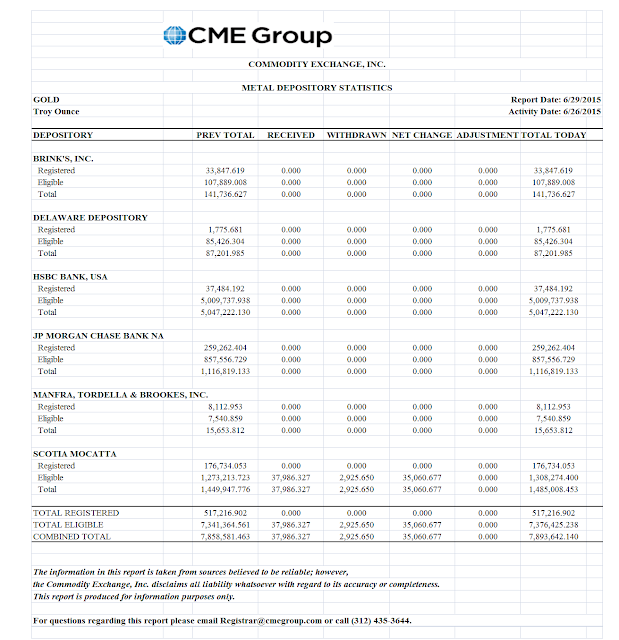

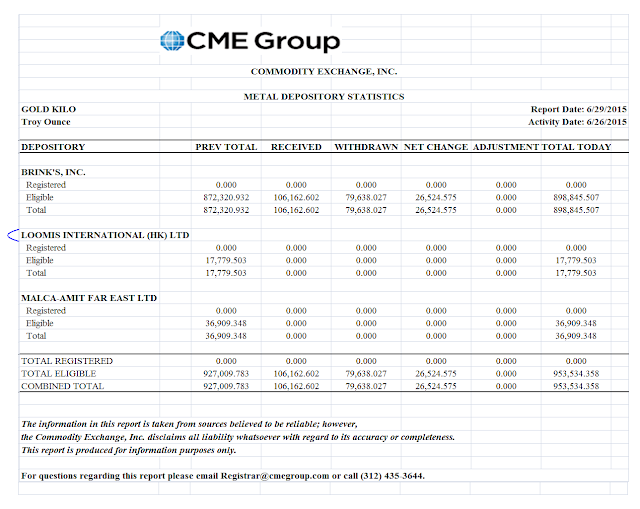

Gold Daily and Silver Weekly Charts - Capped - The Fog of Currency War

The Lord is my light and my salvation;With the VIX soaring and the US equity markets seeing their first 2% correction in many moons, the capping on the precious metals was determined and obvious.

whom shall I fear?

The Lord is the center and refuge of my life;

of whom shall I be afraid?

Psalm 27:1

So much for 'Greek capitulation.'

I think Syriza realized they were being presented an untenable solution, the 'generous offer' of extend and pretend by Merkel and the Eurocrats, with the IMF playing heavy.

This bailing out of private creditors while extracting a pound of flesh from the Greek people, facilitated by corporate friendly governments, was exactly how Greece came into this situation in the first place.

I thought fomenting a bank closure on Greece by the EU was a bit tough, and probably senseless. Showing them the lash to get them to fall to heel and all that.

Most economic commentators in the US are completely clueless about money these days, and global economics as well.

More surprises will therefore be coming I am sure.

Have a pleasant evening.

SP 500 and NDX Future Daily Charts - 2% Correction, Long Overdue

US equity markets had about a two percent correction, with the SP 500 testing its 200 DMA.

Forget the domestic economic news, it was all geopoliticals and mostly about Greece.

The markets do not like the uncertainty of what will happen in Greece, as well as Puerto Rico and the Ukraine, not to mention the wavering financial assets bubble in China.

I am treading slowly through the commentary and news about Greece. The least helpful are those who are mostly projecting their egos or some ideology.

This is primarily a political problem. Greece has a left wing government that the Western powers find unattractive compared to the puppet governments which have facilitated the bailing out of Greek's private creditors while sustaining an unsustainable economic situation.

I am puzzled by Jeffrey Sachs who suggest that Greek default on their debt, but remain in the Eurozone. I am not quite sure how they might do that, and while Jeff says their is no mechanism to actually kick them out it does seem a bit too cute. The EU does not have a mechanism for forgiving one member's debts and not another's either.

Have a pleasant evening.

NAV Premiums of Certain Precious Metal Trusts and Funds

"Force may make hypocrites, but it can never make converts."

William Penn

Despite unfolding debt crises in Greece, Ukraine, and Puerto Rico, the flight to safety in precious metals is being well managed in the paper markets.

The gold/silver ratio is nose-bleed high.

The premium on Sprott Silver is slightly positive, showing a bit of resistance for those holding physical bullion, even if by proxy.

The confidence game is long in the tooth, and some are not willing to play this time. Much moreso in the physical bullion markets of Asia. They are playing by stacking.

Subscribe to:

Comments (Atom)