Gold and silver just drifted, held in their places after the excitement of the beginning of the week.

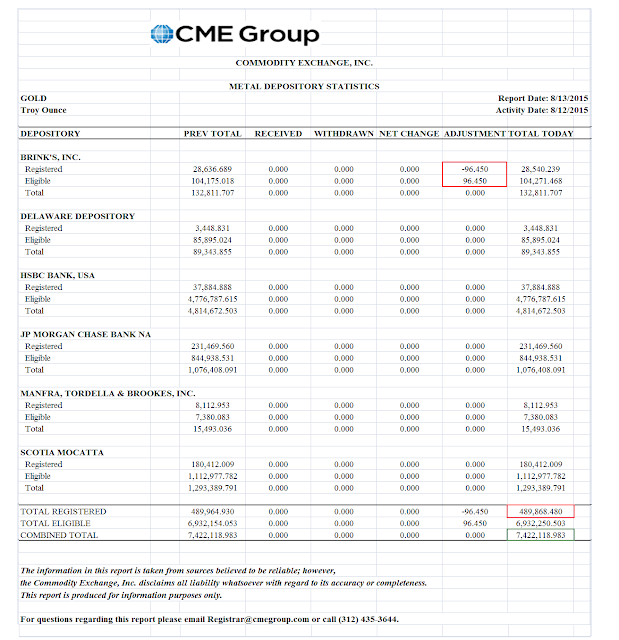

There was no delivery activity at The Bucket Shop yesterday, and just trickles of bullion out of the warehouses as shown below.

Let's see if next week brings us any surprised, most likely from overseas.

I do think that looking out six months that we will likely see a widening of the swings in volatility, as events drive real people to take certain decisions, and the Banks and their government associates seek to stabilize and maintain their status quo.

But why guess? Let us just take it as it comes. In particular we will be watching the volatility swings in stocks, and for the usual and important support and resistance levels on the charts.

In particular physical delivery of bullion is worth watching, especially since there is so much disinformation being spread around about it. What worries the financiers is always of interest to common people like us.

It looks like gold imports to India jumped 62.2% in July.

FOMC minutes next week. I suppose we will have to endure the usual speculation and market antics associated with 'will they or won't they.'

The Fed will raise rates at least 25 bp off the zero bound in September or December at the latest unless the wheels are falling off the global economy. It has little to do with any real recovery, but is just another manifestation of their bank-centric, one percent trickle-downism.

If you have a chance try to watch the full five part series about The Man Who Knew Too Much from The Real News. I found the discussion to be fascinating.

Watching the conversations related to the political scene are a little more interesting now that the politicos are swarming the channels in anticipation of the big Election next year. I have included an updated chart of the 'Political Continuum' below.

You can divert yourself on these hot lazy days by trying to place the various candidates on the charts, and perhaps even yourselves. The toughest ones to place are likely to be opportunists, narcissists and sociopaths.

This is because they may have no inherent principles others than self-advancement or youthful experimentation. I know that I moved all over the chart when I was younger, and spent quite a bit of time on right side of the circle, but as I grew and aged and raised a family I started settling in the center and then to slightly left of center in the 'progressives.' There are tests online that will help to place you if you answer them honestly.

I am not surprised that with such a range of choices and so many candidates, that so many people feel alienated with no clear cut choice. I would find myself very hard-pressed to vote for either of the two establishment candidates, Bush or Clinton. And the rest of the broad range of the candidates seem to have been made from a cookie cutter, except for two. And therein lies both opportunity and danger. But it is still very early days and things may look very differently by Spring.

Reform is a lonely watch, because you are without a doubt running against the mainstream current of the powerful in a society. One has to find some principle other than self-interest to sustain them. It is a good time therefore for religious feelings, narcissist pre-occupation, banal greed, and political extremism. People will always find something to worship, one way or the other.

Have a pleasant weekend.