“Exceptionalism”—the view that the United States has a right to impose its will because it knows more, sees farther, and lives on a higher moral plane than other nations—was to them not a platitude, but the organizing principle of daily life and global politics...

With a glance, a nod, and a few words, without consulting anyone other than the President, the brothers could mobilize the full power of the United States anywhere in the world."

Stephen Kinzer, The Brothers: John Foster Dulles, Allen Dulles, and Their Secret World War

17 October 2015

Stephen Kinzer: The Brothers - Rise of Exceptionalism and Aspirations of Empire

Shanghai Gold Exchange Withdrawals Running at Record Pace

Withdrawals of gold from the Shanghai Exchange alone are at 1,958 tonnes for the year. The first chart below compares that pace to the prior years.

As I noted the other day, the mispricing of value and risk in the gold market, primarily driven by traders in London and New York, is calling a form of Gresham's Law into action.

Gold in the New York and London vaults is heavily leveraged and hypothecated. The full extent of this is not disclosed and can only be surmised.

If the tide of gold keeps going out at these amounts, we will see who is wearing what, as the old traders say.

Is this a 'problem' that we need to save them from? Hardly. This is a problem which they have created by manipulating this market and trading it with reckless disregard as they have done with so many others.

The only 'help' they require is to allow the market to set the price, and abide by some modest rules of leverage and risk management, rather than sacrificing safety and fairness for short term gains.

Gold is flowing from West to East. Of this there should be little doubt except for the most hardened apologists for the bullion banks.

Category:

Shanghai Gold Exchange

16 October 2015

Gold Daily and Silver Weekly Charts - Das Schwerste Gewicht der Außergewöhnlich

Gold and silver were relatively quiet most of the day.

The both were smacked down very late, into the New York close. It was not substantial, more gratuitously petty.

This barely qualifies as a retracement, which you may know I am looking for about here, and laid out in the overnight posting A Closer Look At the Gold Chart Formation: Three Scenarios.

I don't think I can stress enough that the trading in gold, and to a lesser extent silver, has become 'virtual' in that it is trading almost like a stock, or an option, rather than a commodity. The coupling with the physical market has drifted away, and the reconnection of the paper and the physical markets will be impressive.

And today I put out another thought on this notion of a paper market that has become divorced from the physical transactions, which have clearly shifted to Asia. You might wish to read about this split markets in the precious metals here in Nova Scotia Apparently Backing the Meager Action In Comex Gold.

The more I step back and look at what the precious metals have become the more amazed I am that no one has taken this on, whether it be a big trader or a regulatory body.

Perhaps this is all a part of the unbearable lightness of being exceptional? Uniquely one of a kind?

No, the gold market in New York and London, within the context of the greater global market, is the poster child for fragility. It is a very old story, and lately almost cliché, about overreach, the abuse of trust, and reckless greed.

And the same goes for silver, although that market has a slightly different set of challenges and oddities of its own.

I sure that time will sort all of this out.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - Option Expiration - All Quiet on the Western Front

Stocks had their October option expiration today.

The antics were abundant as stocks came in lower, but drifted higher during the day, and were jammed higher into the close for a gain.

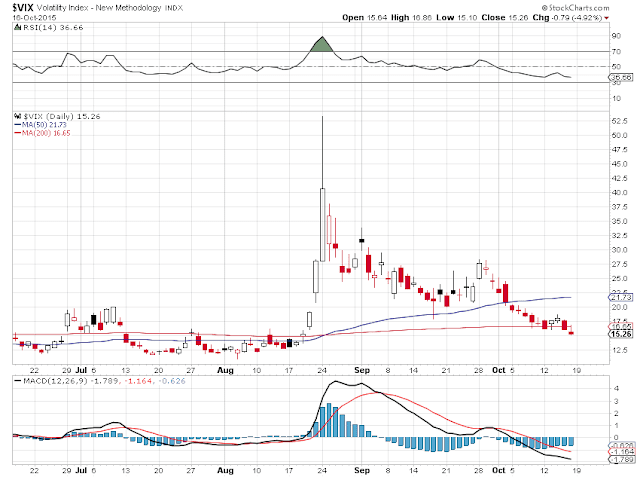

The obsessive compulsive Street has decided that all is quiet on the Western front, and VIX has dropped back down to the 'new normal.'

The meme is that the Fed will not be raising rates in the foreseeable future, and all that selling in China is done now that margin debt has been unwound.

The economy is lousy, and risks are mispriced, but why worry? The Fed can always bail us out.

Have a nice weekend.

Subscribe to:

Comments (Atom)