05 November 2015

04 November 2015

Gold Daily and Silver Weekly Charts - Smackdown

"But he saw too that in America the struggle was befogged by the fact that the worst Fascists were they who disowned the word 'Fascism' and preached enslavement to Capitalism under the style of Constitutional and Traditional Nativist American Liberty."

Sinclair Lewis, It Can't Happen Here

Gold and silver were taken lower in further programmed selling in New York today.

Gold is testing the 1100 support level and silver is trying to hang on to the 15 handle.

What was most impressive is that they managed this selloff on a day when the rest of the markets could not make up their minds what to think. And there are now trial balloons being floated about 'negative interest rates' and 'killing cash.'

There was intraday commentary on gold and silver here.

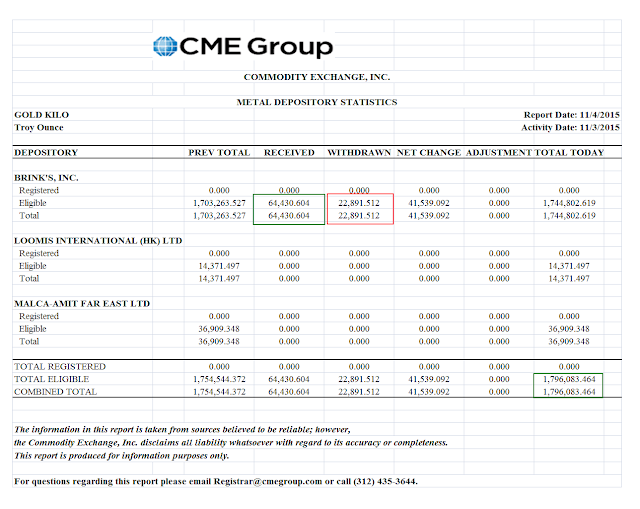

Nothing much in the way physical activity happened in The Bucket Shop. Just the usual slow leakage of bullion.

Non-Farm Payrolls on Friday.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Bipolar Interest Rate Psychosis

The markets cannot quite seem to know what to do and where to go these days. Perhaps that is what happens when they diverge from reality, and begin to live in the shadows of the bipolar Federal Reserve that one day sees an improving economy demanding higher interest rates, and the next a slump that opens the door to draconian regime of negative interest rates.

I know the Fed's game is to keep the markets guessing. The problem with this is that it is hard to tell what these jokers will do next, because the thought leaders of this glorious republic are caught in a massive credibility trap in which black is white, war is peace.

Oh well, tomorrow is still another day. And we have the drama of the Non-Farm Payrolls ahead of us, sure to be seasoned with the numerical slant du jour.

Have a pleasant evening.

NAV Premiums of Certain Precious Metal Trusts and Funds - Killing Off Cash, Negative Rates

Approximately 11,293 troy ounces (only about .35 tonnes) of gold was redeemed from the Sprott Physical Gold Trust in return for 1,365,920 units since the last time I updated this on October 25th. That prior chart is included below the current data.

You may make what you will of this, but the fact remains that there is little redemption of units for silver. And there is a general decline in gold held by Western ETFs and Funds, and heading to Asia. It could also be some sort of arbitrage, but I am struggling with that one, again because it only seems to be happening with gold.

Or perhaps the Chia Pet or Pet Rocks people are diversifying their product offerings.

Business Insider Australia has an interesting article, Killing off Cash, and Imposing Negative Interest Rates.

Janet Yellen did not rule this out in her congressional testimony today. No wonder the wealthy are stashing their cash in offshore havens.

The cash balance in the Sprott Physical Silver Trust has gone more negative, as short term payments are most likely delayed, and/or short term operating loans taken. It appears that another sale of silver bullion to raise cash for the fund may be in the works, pending the outcome of their acquisition proposals perhaps.

There was a marked decline in the cash assets of the Central Fund of Canada. They paid a 1 cent per Class A Share annual dividend on October 28, which would account for about $2,544,327 of that.

Category:

NAV of precious metal funds

Subscribe to:

Comments (Atom)