“Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.”

Nassim Nicholas Taleb, Antifragile

"When the rich wage war, it is the poor who die."

Jean-Paul Sartre

As I have noted previously, at times the precious metals trade as currencies, without regard to their significant supply and demand conditions as commodities.

The forex market is notorious for overextending trends, and as acknowledged of late by some, of instances of price rigging.

The Fed and the central banks do own a printing press.

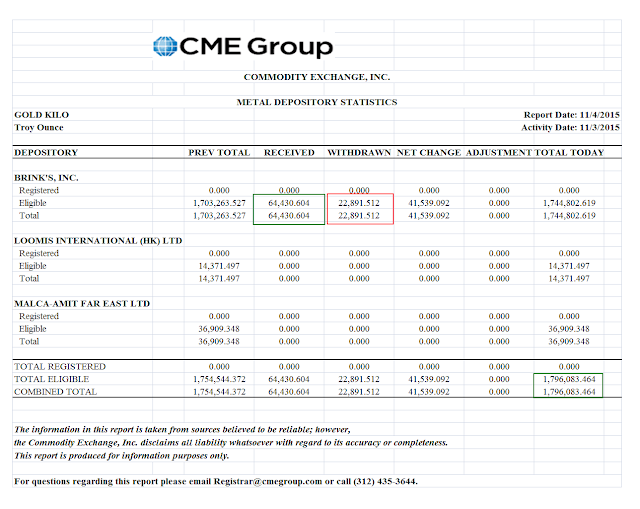

But these days the gold in which their Banks traffic often has merely the appearance of solidity, appearance magnified and leveraged by paper.

Tomorrow we will have a look at Non-Farm Payrolls for October.

These things develop slowly over time, and forecasting their ebbs, flows, and break points is not possible.

Have a pleasant evening.