Very little of consequence occurred at The Bucket Shop today.

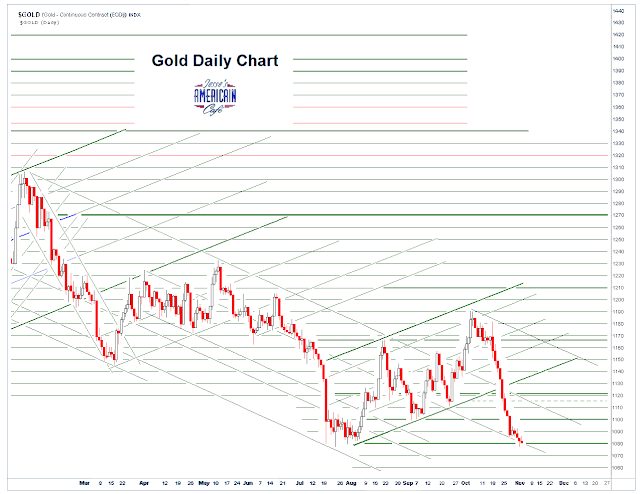

Gold had the usual rise and then smack down into the London PM fix and the New York open, just to give the sleeping pit crawlers a wake up call, and then bounced along 1180 support for the rest of the day. Silver was pretty much a copy cat, or vice versa.

There were no deliveries made for the precious metals at the Comex yesterday. As Dr. Zoidberg says, 'what a surprise!'

And as you can see on the domestic warehouse reports below, little happened except for the slow rim-leak of bullion outbound.

Hong Kong was quite a different matter yesterday. So much so that it merited some intraday commentary About 38% of All the Comex Gold in Hong Kong Left the Warehouses Yesterday.

In the course of finding yet another excuse not to go out and take care of the leaves again, I took some time to write an open letter to Mr. Paul Krugman titled, An Open Letter to Paul Krugman on the 'Republican Lust For Gold.'

Perhaps I should have said, 'so-called lust for gold.'

I mean, besides Rand Paul and his father, there may be an abundance of lust for certain things among the GOP and the Wall St Democrats for that matter, but not much of it is for the betterment of the common people and their experiences with money and markets.

In fact, one might be excused if they think that in practice there is little difference between the 'establishment Republicans' and the 'Wall Street Democrats' except for names of the billionaires who sign their paychecks.

And what flaming liberal Democrat took us OFF the gold standard for the dollar with regard to international monetary settlements and valuation, and unilaterally slammed the gold window shut?

Richard Nixon. Oh yeah, that Republican. Like most of the ruling elite no lust for gold there: just power.

Let's see if gold and silver can hold their levels here.

And let's see if the financiers can once again 'pass go' and collect their big fat bonuses without blowing up any new markets, or institutions, or countries between now and the New Year.

Have a pleasant weekend.