13 November 2015

Gold Daily and Silver Weekly Charts - Life Imitates High School, Or Monopoly

Very little of consequence occurred at The Bucket Shop today.

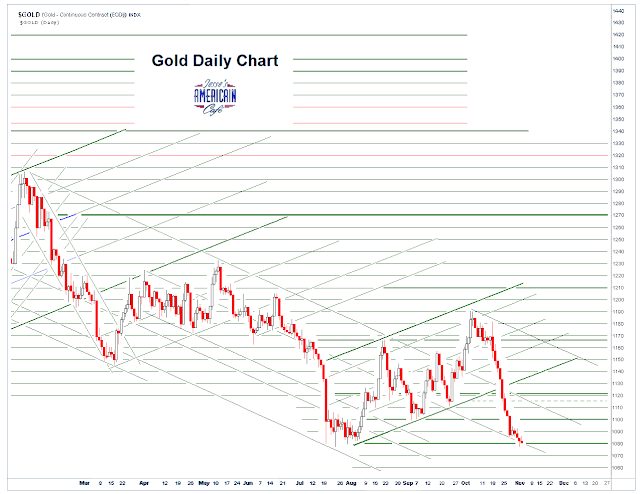

Gold had the usual rise and then smack down into the London PM fix and the New York open, just to give the sleeping pit crawlers a wake up call, and then bounced along 1180 support for the rest of the day. Silver was pretty much a copy cat, or vice versa.

There were no deliveries made for the precious metals at the Comex yesterday. As Dr. Zoidberg says, 'what a surprise!'

And as you can see on the domestic warehouse reports below, little happened except for the slow rim-leak of bullion outbound.

Hong Kong was quite a different matter yesterday. So much so that it merited some intraday commentary About 38% of All the Comex Gold in Hong Kong Left the Warehouses Yesterday.

In the course of finding yet another excuse not to go out and take care of the leaves again, I took some time to write an open letter to Mr. Paul Krugman titled, An Open Letter to Paul Krugman on the 'Republican Lust For Gold.'

Perhaps I should have said, 'so-called lust for gold.'

I mean, besides Rand Paul and his father, there may be an abundance of lust for certain things among the GOP and the Wall St Democrats for that matter, but not much of it is for the betterment of the common people and their experiences with money and markets.

In fact, one might be excused if they think that in practice there is little difference between the 'establishment Republicans' and the 'Wall Street Democrats' except for names of the billionaires who sign their paychecks.

And what flaming liberal Democrat took us OFF the gold standard for the dollar with regard to international monetary settlements and valuation, and unilaterally slammed the gold window shut?

Richard Nixon. Oh yeah, that Republican. Like most of the ruling elite no lust for gold there: just power.

Let's see if gold and silver can hold their levels here.

And let's see if the financiers can once again 'pass go' and collect their big fat bonuses without blowing up any new markets, or institutions, or countries between now and the New Year.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - This Is Why We Can't Have Nice Things

But the wiseguys certainly did not waste any time getting here.

Tell me, what happened this week that changed the entire complexion of the equity market, which rose in an almost unstoppable manner from a hard bottom back to challenge the all time highs in a matter of a few weeks?

What new wisdom did the trading desks and the algos discern that turned sentiment on a dime from mindless greed to panic and fear?

Or was this the usual 'wash and rinse' that one might expect in a market dominated by relatively unregulated behemoths who feel free to shove prices around like a pinball machine, all the better than to consume the public with, my dears?

Well, take heart young bulls. IF the market can stop and make a stand within a little leeway to the downside, then it has a good chance of doing this all over again and providing the one percent with yet another 'Santa Claus rally' and a 'Merry Christmas' to them.

I took all my short positions and VIX long off. I don't remember if I mentioned that. Now we will see what this latest attempt by the financial community to baffle the world is all about.

I would give that a 50-50 at least at this point, and cannot quite see things going much lower, unless they are really of a mind to take it all the way down, and bring it all the way back up in December, lets say on the news that the Fed did not have the stones to raise rates after all that.

Nomi Prins does not think that they will. And I respect her judgement. But having missed their window, and being preoccupied with doubts about their whacky QE and Twist programs that have accomplished almost nothing except ghosting the middle class and upsetting the balance of power in the republic, I really hesitate to put anything past their busy little financial engineering hands.

We will sacrifice all, our lives, liberty and sacred honor, for the Banks.

Have a pleasant weekend.

About 38% of All the Comex Gold in Hong Kong Left the Warehouses Yesterday

Perhaps it went out for some dim sum. TTFN, but be right back!

Roughly 21 tonnes, or 685,652 troy ounces of gold in .999 fine kilo bars, was withdrawn, net of a small deposit of 27,328 ounces, from the Brinks warehouse in Hong Kong yesterday.

To put that into some perspective, that is the same amount of all gold in the entire JPM warehouse in the US.

Now compared to the Comex US, in which very little gold bullion actually changes hands or goes anywhere, that is a huge number. But Hong Kong is typically seeing large inflows and outflows of gold. Because that is how the precious metals market has been manifesting in Asia since about 2007: not with endless chains of paper just changing hands in a grand game of liar's poker, but with the physical exchange of bullion.

And most of that bullion leaves the warehouse and does not come right back, as Koos Jansen has explained repeatedly about the operations on the Shanghai Gold Exchange. It is being accumulated on the mainland, and this probably does not include the PBOC official purchases.

The point of this is that the price discovery in New York is becoming increasingly distinct from the actual physical supply and demand flows of bullion which are taking place in Asia. As I have said, gold is 'trading like a modern currency' without respect to its nature as a commodity bound by physical supply. The Fed et al. can print money, but they cannot print bullion. That is the point of it.

And that is a potentially dangerous development, especially with respect to a commodity that is being traded at a leverage in excess of 200:1. And in the face of shrinking inventories of gold available for delivery at current prices in both New York and London.

I have put the most recent report for all the US warehouses registered with Comex below that of Hong Kong.

As the Comex told Kyle Bass, 'price' will take care of any imbalances. Yes, just as smoothly and seamlessly as it did when the price of highly levered and risky paper corrected back to reality in 2008. Ba-boom!

Are you kidding me? That is what Kyle Bass said, not me. 'Just give me the gold.'

And if people should choose to stand for physical delivery given the relative scarcity, how much of a price adjustment might be required if they could even find any to be had without an onerous delay and in sufficient numbers?

At the A&P?

How many people, once again, are going to be allowed to walk blindly into another financial buzz saw caused by reckless gambling on Wall Street? Are we willing to repeat the folly of MF Global on a grand scale? Will the rest of the world be so cowed by the Banks as its investors?

Subscribe to:

Comments (Atom)