The downside from this current US election season, besides being faced with some more repugnant choices than usual, is that the blatant hypocrisy and corruption of our ruling elite is exposed for all to see.

I wonder if this will be an historic moment when both of the leading candidates are facing prosecution. Trump for the fraud that was his 'university,' and Hillary for her serial violations of US law while in 'public service.' I think that the three most likely paths for her, depending on whether she takes the presidency or not, are indictment, an official/de facto presidential pardon, or impeachment.

Anyone who has been watching the US for any length of time knows that those two both have more bodies buried than an urban graveyard. And they will be 'owned' by those with the evidence, in addition to the usual well-heeled suspects who buy politicians like most people buy underwear. And with about as much civic

gravitas.

Well enough about that. Speaking of blatant hypocrisy and corruption, US equities made a credible showing for an option expiration, doing what they must to separate the most retail money from its holders.

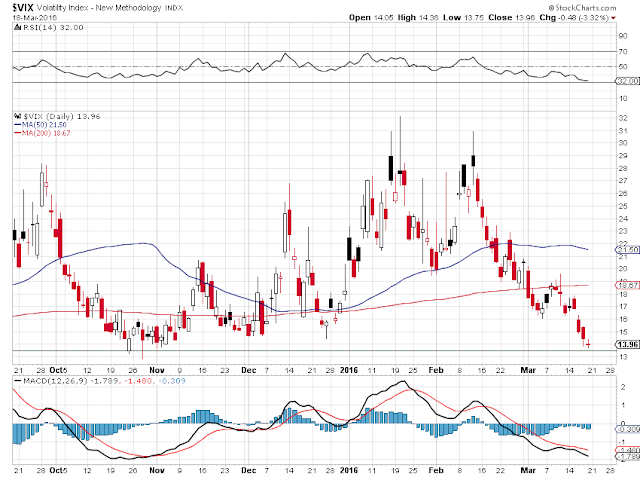

Stocks seem a bit overextended here, and a quick glance at VIX, the measure of market volatility, shows a relative complacency looking back over the last six months or so, although it is still well out of single digits.

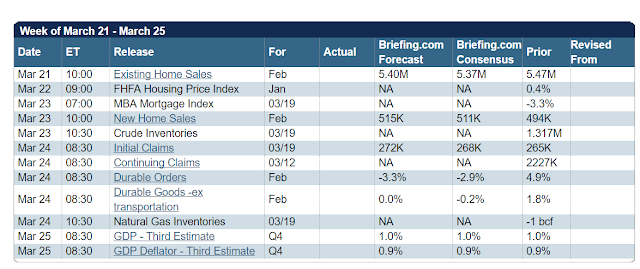

Next week will be a light economic reporting week.

Have a pleasant weekend.