"This elite-generated social control maintains the status quo because the status quo benefits and validates those who created and sit atop it. People rise to prominence when they parrot the orthodoxy rather than critically analyze it. Intellectual regurgitation is prized over independent thought. Voices of the dispossessed, different, and un(formally)educated are neglected regardless of their morality, import, and validity.

Real change in politics or society cannot occur under the orthodoxy because if it did, it would threaten the legitimacy of the professional class and all of the systems that helped them achieve their status...

Even Alan Greenspan admits that neoclassical economics has flaws in theory and practice, yet it continues to be the dominant model at universities and in society. The faulty belief in the uber-rational, self-interested homo economicus probably persists mainly because it is a projection of the people who inhabit the privileged class.

Corporate externalization of costs are absorbed by society and forgotten when heralding the successes of industrialists and capitalists. Resource extraction and environmental degradation, which are part and parcel of production, consumption, and consequently, economic growth, are downplayed or ignored."

Kristine Mattis, The Cult of the Professional Class

"I don’t think there’s any doubt that quantitative easing enabled the rich and the quick. It was a massive gift… I hope that we do indeed succeed in being able to say in the end the wealth effect was more evenly distributed. I doubt it.”

Richard Fisher, former Dallas Fed President

"A glance at the situation today only too clearly indicates that equality of opportunity as we have known it no longer exists... We are steering a steady course toward economic oligarchy, if we are not there already."

Franklin D. Roosevelt, Commonwealth Club Address, September 1932

Sounds like 'the credibility trap' in action, acting as cover for a generation of self-deluding narcissists who can do no wrong, because they define what is right, most often after the fact.

Gold and silver were hit by cheap shot selling in the very quiet Sunday evening trade. And then today gold went zig-zagging in a narrow range today as silver hung on to the 15 handle with its fingernails.

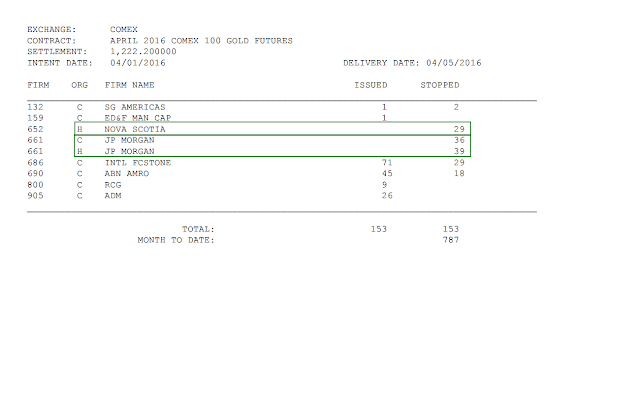

There were some deliveries of gold at The Bucket Shop last Friday, most of which were taken up by the house at JPM and friends. There were no silver deliveries.

The activity in the warehouses was minimal.

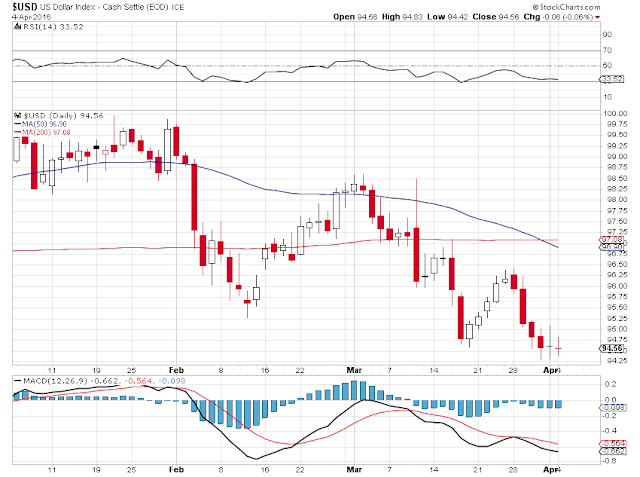

We continue to wait for the chart to strike some direction, and active or nullify the currently developing chart pattern.

I was very sorry to see that the blog Some Assembly Required has closed its doors. I have seen a lot of things changes, a lot of good people and internet sites come and go, over the last sixteen years. I started blogging on a different site on the now forgotten Yahoo Geocities before 9/11 around the turn of the century. It was mostly a collection of short term charts, updated with a remarkable frequency intraday.

And loads of creative, gimmicky things like music and animations and pointed commentary on the news of the day. If one looks long enough, you can spot the malfeasance in financial matters often undetected by the passersby. And I developed my primitive use of cartooning. It was very engaging to watch the currency wars unfolding, the rise of multinational criminal organizations called Banks, and the repudiation and gradual receding of nearly everything good in the face of boundless greed.

When one is placing personally significant sums on the line for the short term, there is a lot of dead time spent waiting for things to happen, or not. It is like waiting for the tourists to arrive at a shill-laden poker table or deadly dull sports book filled with old men betting the over/under on their next retirement check in Las Vegas.

And that time will be filled, somehow. Generally with porn, video games, and pointlessly rude comments, judging by the content of the internet. And of course, the occasional gems of real information laying buried or distorted by the official media mouthpieces.

If producing a blog or moderating a chat forum, which at a distance must seem to be highly attractive endeavors to those who have never done them, is not a frankly commercial enterprise that pays a livable return in money, which alas one always seems to serve over time, then it must become a calling of some sorts to endure.

The non-monetary returns of creative sharing, in purely worldly measures, are rarely commensurate to the effort. One comes for a benefit, but at the last finds a work.

"I'd rather live in His world, than without Him in mine."

Have a pleasant evening.