Corporate Media Attempts Clinton Coup d'Etat On Eve of Super Tuesday Elections

By Pam Martens and Russ Martens: June 7, 2016Hillary Clinton was not having a very good morning yesterday. The New York Post had devoted its full front cover to suggesting that Clinton has a Dr. Jekyll and Mr. Hyde personality disorder, based on an explosive new book by a former Secret Service agent who was stationed directly outside former President Bill Clinton’s Oval Office and is alleging outbursts and physical violence by the former First Lady.

The book has shot to number one on the nonfiction bestseller list at Amazon.com, meaning more headwinds for the Clinton campaign. On top of that, news was swirling that Senator Bernie Sanders had a good shot of trouncing Clinton in the following day’s critical primary in California, where a massive 475 pledged delegates are at stake. (Five other states are also set to vote today in primaries: New Jersey, Montana, North Dakota, South Dakota, and New Mexico.)

And then a funny thing happened. At 8:20 p.m. last evening, the Associated Press, which syndicates its news feed to newspapers around the country, ran a story with this headline: “Clinton has delegates to win Democratic nomination.” That quickly morphed into bizarre headline pronouncements that Clinton had actually “won” the Democratic Presidential nomination. Bloomberg News’ went with the craziest headline of the lot, writing: “Clinton Wins Democratic Presidential Nomination.”

Most Americans reading that would assume the Democratic Convention had just been held, votes taken, and Clinton had walked away as the winner. The actual votes won’t be taken until July 25-28 when the Democratic National Convention takes place in Philadelphia....

Read the entire story from Wall Street On Parade here.

07 June 2016

The Mask Falls Off

06 June 2016

Gold Daily and Silver Weekly Charts - Fed Cred

"The world can appear to be so empty if one thinks only of mountains, rivers, and even cities; but to know someone here and there who thinks and feels along with us, and though distant, is close to us in kindred spirit - this makes the earth seem like a peopled garden."

Johann Wolfgang von Goethe

Too bad that the Fed's policies are turning most of the real economy into a barren parking lot.

Janet Yellen was out speaking today, trying to salvage some shred of the Fed's credibility after that awful Non-Fulltime Payrolls Report last week.

But despite the happy talk it just did not work.

Maybe people are listening to what the Fed heads are saying, but looking at the Fed's own data and seeing things like this chart on Labor Market Conditions on the right.

As you may recall, the Fed will be meeting FOMC style next Tuesday and Wednesday. It is unlikely that they can raise rates by even 25 bp and ascribe that to economic necessity. If they cite their own policy needs then maybe. How can they lower rates again, given that negative rates are like some cruel prank gone viral, and they are still stuck near ZIRP?

If rates ever do start going up with conviction look for a bloodbath in the bond markets. And we have not seen anything like that yet.

Gold and silver were just moving sideways for much of the day in a very dull trade.

There was another big set of deliveries recorded at the Comex last Friday.

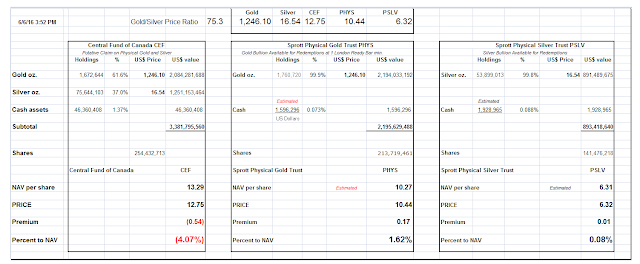

The NAVs of some of the Precious Metal Trust and Funds were also posted intraday and are worth a look.

Today's market action gave me the urge to go out and cut my grass, so I think I will do just that.

Have a pleasant evening.

Related: Fed Labor Market Conditions Worst Since the Great Recession

SP 500 and NDX Futures Daily Charts - Hypocrites' Oath

Stocks were drifting in a relatively lackluster day.

For the first weeks in June it seems more like the dog days of Summer already.

It was very interesting to hear US Treasury Secretary Jack Lew lecturing China about what they ought to do with their economy. It was like listening to the king of the bar flies lecturing the people about the virtues of sobriety from his favorite corner stool.

There has been no recovery.

Tomorrow is a Super Tuesday in the Democratic primaries.

Have a pleasant evening.

Subscribe to:

Posts (Atom)