Gold and silver held to an upward drift today, with a little more strength in Uncle Buck. One gets the sense that the 'risk on' boys were taking a little out of equities and putting the proceeds into safer harbors.

The big movers for the metals this week will most likely be the Bank of England rate decision and the US Non-Farm Payrolls Report.

And as always, any exogenous hiccups in the smooth seas being prepared by the central banks, who are spreading the oil of excess liquidity and negative rates on the choppy seas of poor economic growth.

Gold in particular is at an interesting juncture on the charts again. And as the stock commentary below points out, stocks have been on a tear for some time, and are looking a bit fully valued and even 'toppy.'

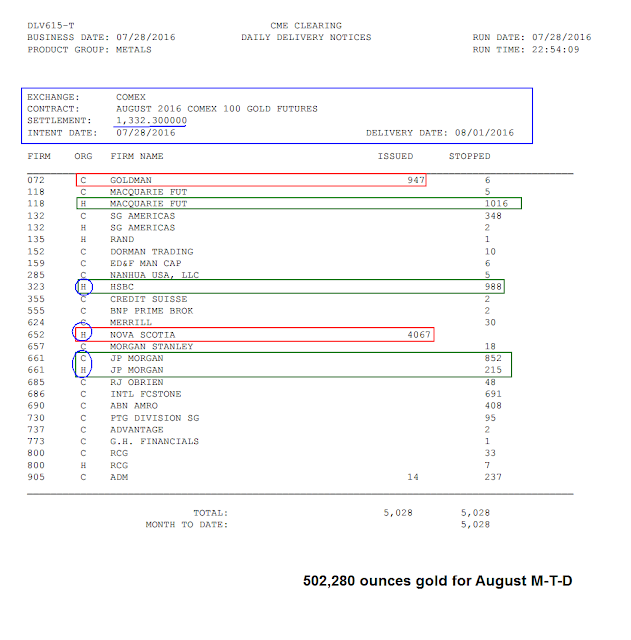

There were more deliveries in gold last Friday, with the takers being the usual suspects. Interesting that despite all these deliveries that the gold inventories in the warehouses move very little.

Silver bullion is in for a quiet August on the Comex it appears.

The gains that have been achieved in the mining stocks year-to-date have been quite impressive.

I am wondering if and when those gains and higher metals prices will be reflected in real earnings. Right now there appear to be quite a few 'if-come' bets.

Have a pleasant evening.