19 October 2016

18 October 2016

Gold Daily and Silver Weekly Charts - We Come In Peace

"The wealth of another region excites their greed; and if it is weak, their lust for power as well. Nothing from the rising to the setting of the sun is enough for them. Among all others only they are compelled to attack the poor as well as the rich. Robbery, rape, and slaughter they falsely call empire; and where they make a desert, they call it peace."

Tacitus, Agricola

"When the rich wage war, it is the poor who die."

Jean-Paul Sartre, The Devil and the Good Lord

Gold and silver look to be 'pegged' around these levels for now.

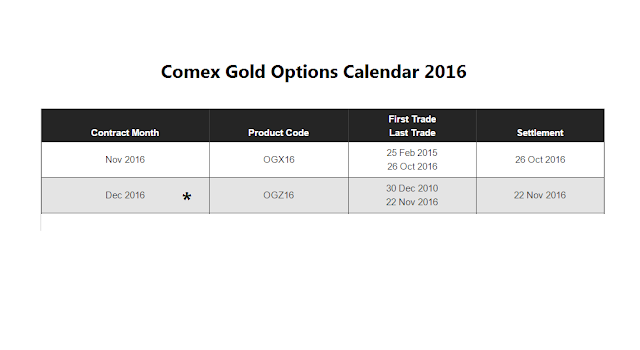

There was little clearing activity yesterday on the Comex, and the warehouses were a snooze as well.

The dollar lost a bit today, but regained it back.

Gold and silver are chopping sideways now, as can easily be seen on the chart.

They will resolve this impasse at some point.

Let's see which way that they go.

The mispricing of risk is like karma; it comes back around when you least expect it.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Risk On

Stocks were risk on today, bouncing off support.

Although it seemed like that brisk feeling of defying the potential dangers of a faltering world order and wobbly economies in order to chase a bit of short term return faded a bit into the close.

The underpinnings of the market are weak, because the time horizon of most of the daily holders of stocks can be measured in seconds.

So on an 'exit-provoking' event, we can expect stocks to do a melt down that could be fairly impressive. Perhaps not nearly as impressive as in 1987, but it might seem that way to those whose market memory only goes back to 2002.

Have a pleasant evening.

Subscribe to:

Comments (Atom)