Gold and silver managed to move higher despite the stronger dollar, with gold showing a little more strength.

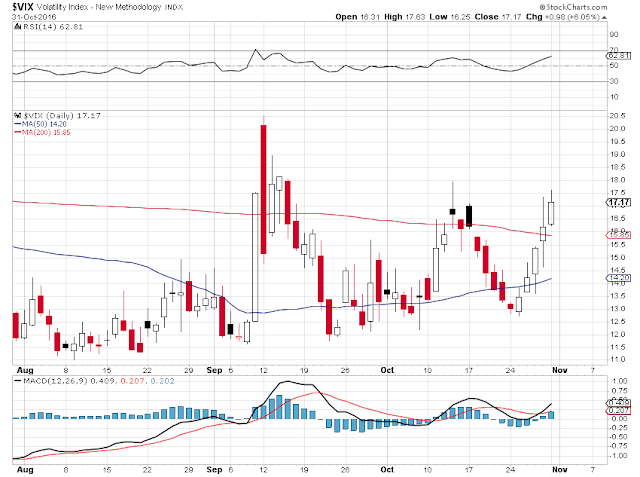

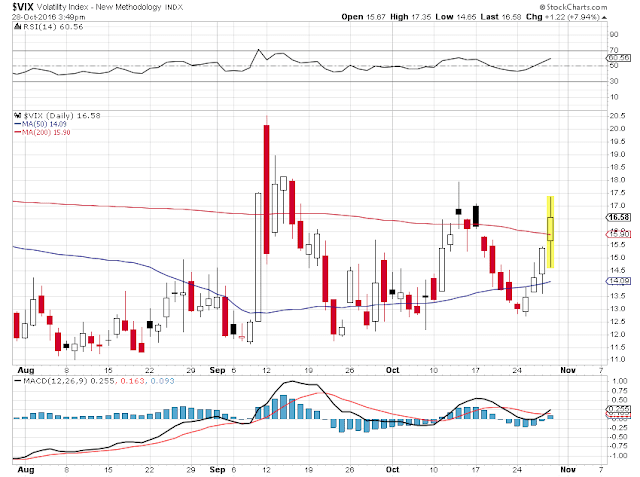

With the VIX also climbing, this looked like a flight to safety of some modest proportion.

Gold is obviously caught in a short term trend. Silver as well, although it is not as easy to see this on the weekly chart.

Over 800,000 ounces of gold have been taken off the Brink's accounts in Hong Kong over the past two days. Perhaps not significant in the bigger picture of things. But still worth noting if such a trend to take physical out of the 'Comex warehouses' there and not replace it.

Quite a few traders are busying themselves by trying to figure out with way assets will move if Trump or Hillary win the election.

I am giving it some thought myself, but for now the only people making money in doing this are those who sell their opinions in one way or another.

Right now I can argue it both ways. And personally I find both candidates to be so distasteful that it is hard to even imagine that they could become the 'leader of the free world.'

Regardless, I think it might be wise to hang on to your wallets, unless you are among the self-chosen elite who seem to have shanghaied the American political system.

Have a pleasant evening.