03 August 2017

The DNC and Media Corporate Establishment Is Grooming Kamala Harris as Obama 2.0

One has to wonder how many humiliating defeats party members, and prospective party members, are going to accept from the corporate Democratic establishment before they toss them out, or form a third party, and encourage the zombie politicians to take their after office deals with their Big Money donors and Wall Street.

01 August 2017

Stocks and Precious Metals Charts - Götterdämmerung - Non-Farm Payrolls Report For July This Friday

"Rome has grown so much from its humble beginnings that it is now overwhelmed by its greatness."

William Blake, The Number of the Beast

Titus Livius

"What we have freed ourselves of, however, is any genuine consciousness of how we might look to others on this globe. Most Americans are probably unaware of how Washington exercises its global hegemony, since so much of this activity takes place either in relative secrecy or under comforting rubrics.

Many may, as a start, find it hard to believe that our place in the world even adds up to an empire. But only when we come to see our country as both profiting from and trapped within the structures of an empire of its own making will it be possible for us to explain many elements of the world that otherwise perplex us."

Chalmers Johnson

"We are imperial, and we are in decline."

Lawrence Wilkerson

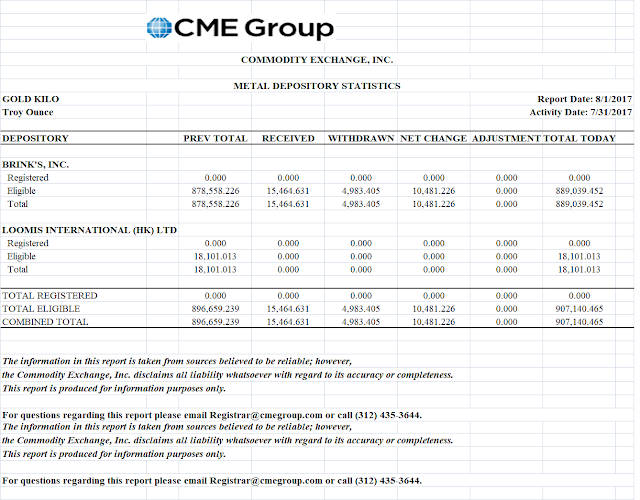

There was an entry earlier today here showing the trading ranges this year in gold and silver, and the stunning decline in the US Dollar Index.

The markets are winding for a move. I am not sure about stocks, but a large decline this fall would not be a surprise.

Greenspan says that stocks are not excessively valued, but that there is a bubble in bonds. Uh-huh.

If there is a bubble in bonds and it deflates, stocks will be crushed.

Risk is so mispriced in so many ways that is it almost astonishing.

As for gold and silver, the capping this year is obvious.

Let's see if they can maintain it. They will, until they cannot.

As noted below on the economic calendar, there will be a Non-Farm Payrolls Report on this Friday.

And then we will see a reckoning of risks.

And no one could have seen it coming.

Have a pleasant evening.

Precious Metals Year-To-Date Trading Ranges, And Stunning Decline in the Dollar Index

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn't. And contrary wise, what is, it wouldn't be. And what it wouldn't be, it would. You see?”

Lewis Carroll, Through the Looking Glass

The Year-To-Date trading range in gold is particularly well-defined, from about 1200 to 1300.

Silver has a less well-defined range, with a secondary declining trend.

The Dollar has just done a swan dive as measured in the DX index.

I would suggest that a breakout in gold will be characterized by a sustained price move above 1300 that manages to hold its ground and advance to take out 1350.

For silver a break above 18.50 would be constructive, although the silver bulls might take *some* encouragement from a successful challenge of the intermediate downtrend which is now around 17.50.

I suspect that the decrease in the value of the Dollar involves a policy move intended to make US exports more competitive, meaning no disrespect to the euro which has been in a corresponding rally based on what, their zombie banking system, or dysfunctional political/economic construct?

Or perhaps it is the reaction of the world to the wild and wacky reign of The Mad Hatter.

Subscribe to:

Comments (Atom)