“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually slaves of some defunct economist.”

John Maynard Keynes

“The job of the Federal Reserve is 'to know when to remove the punch bowl at the party.' Under Alan Greenspan’s leadership its motto became let’s all get drunk and see what happens."

Said Elias Dawlabani

Truly, we are haunted by policy errors past and present.

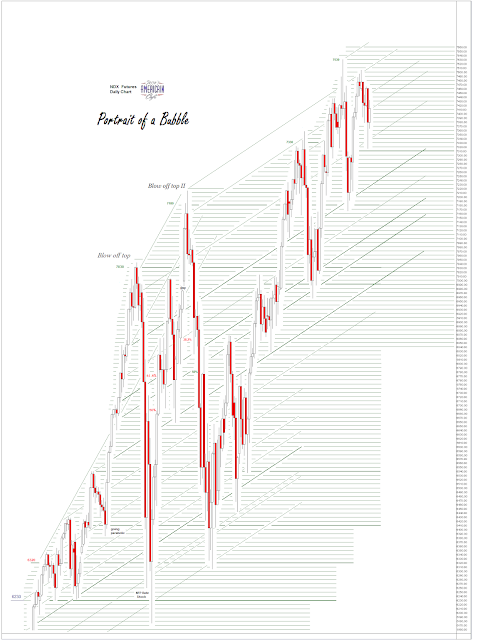

And bubble up to the bar, the boom and bust hits just keep on coming.

Yes folks, hide your wealth, your emerging markets, and what remains of your living wage jobs, it's that time of year again, when the great herd of economists and financial news readers follow Cowboy Jay and his hole in their model gang to Jackson Hole.

The inscrutable in pursuit of the unsustainable.

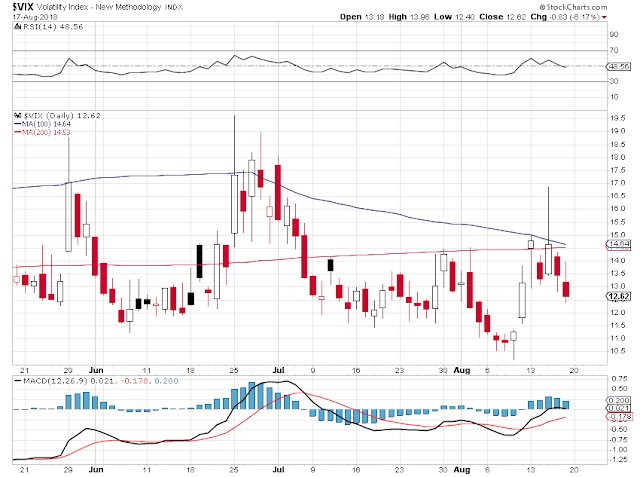

Stocks were largely unchanged today. Tech was the weak link in the chain. Since it is the heart of the latest 'new era' style bubble that bodes ill for this latest pile of paper assets.

Gold rallied again from the deep low it set last week at $1159. It is so deeply oversold for the short term that a rally here is to be expected. We'll have to see what happens next to determine if this is a true trend change or not.

Silver is facing the headwinds of a meaningful option expiration coming on the 28th. Gold's contract is now further out so it will most likely just be hanging around on the corner for this latest scrap between paper and physical.

It seems to be the fashion for Hollywood celebrities to be 'shaming the voters' for the latest failures of the corporate Democrats in the voting booths. Of course they are just following the lead of the Democratic leadership and what passes for thought leaders in the liberal establishment.

It's a sure sign of complacency and rot in the management ranks when you start blaming the customers for your own massive failures to construct a workable strategy that appeals to and addresses their needs.

Of course this is because the DNC has come to consider wealthy donors as their foremost constituency, in the mistaken belief that winning office is just a matter of turning the money crank enough times, buying the right talent, and spinning the reality to fit your own agenda.

And so 'the most qualified candidate' to be beaten by a vulgar reality star and philandering flimflam man flamed out, spectacularly. Who could have seen it coming?

Need little, want less, love more. For if you have no love in your hearts, you will fail to withstand the winds that will be blowing across the lands in the days to come.

Have a pleasant evening.