“OMB Director Mulvaney cites a record high in gov’t revenue. True, revenues hit a high in nominal terms over FY18, growing 0.4% Y/Y, However after adjusting for inflation, growth actually fell by 1.6%”.

The Devil, in Greek diabolos the 'divider', 'scatterer', 'slanderer'

Steve Rattner

"Non Farm Payrolls puffed up all year, major negative adjustment to come later. For most Americans this is not a strong economy, regardless of what Fed or Administration says. When the jobs data is benchmarked to the tax data in February, there will be a massive downward revision.

I just ran the October withholding, and there is no way that this number is correct. Withholding was extremely weak. Bureau of Labor Statistics overstating gains all year."

Lee Adler, Capital Stool

"Thanks [Lee] for the insight on the inconsistency of NFP with payroll withholding. I was about to have a quick look at tax receipts but you saved me from that task. As for avg wages rising I expect much wage gains concentration in top 10% (supervisory), similarly for per capita incomes... [for a truer picture look at median numbers especially in times of record income disparity]

BLS says 250,000 jobs created. Zero attention to how number compiled. BLS number helped each month by "birth-death" ESTIMATE to account for unknown business shutdowns and startups. Guess what? The Birth-death estimate this time was +246,000. Good NFP before midterms."

Harald Malmgren

I would also point to the downward revision already from last month's headline number, in addition to the nice fat estimate from the 'Birth-Death' imaginary jobs estimate that helped to boost the headline number.

And few mainstream economists look at these big benchmark revisions as referenced above with a critical eye. That is where independent analysts like Lee Adler come in.

You have no idea [well, maybe you do] how glad I will be when these midterm elections are over. I have never received so many junk 'robo' phone calls, or knocks at the door, or seen so many ludicrously slimy TV ads.

Stocks put in another 'pop and flop' kind of day, finishing nearly unchanged after a ranging day of highs and lows that were remarkable.

This is not bullish, and not constructive action for equities.

Bully better hope that nothing untoward happens to trigger a selloff, before corporations can start using their tax cut money and dodgy accounting booty to game their stock prices through billion dollar buybacks again.

They *could* end up like GE some day, after many billions spent buying back their stock and not reinvesting in the business. They are now teetering, and some fear they may fall over into bankruptcy.

But the managers who ran the stock buybacks have cashed in their big stock price related bonuses and options, and have taken the money and run.

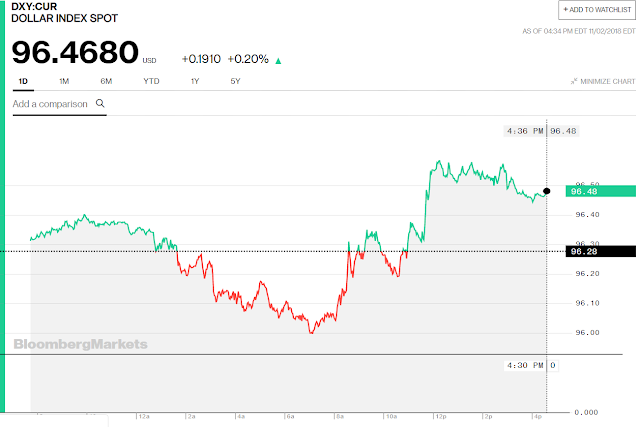

Gold and silver put in a weak performance but managed to hold their recent gains as the dollar chopped sideways after its big selloff from the recent top.

There will be an FOMC meeting next week. I have included the economic calendar. They are not expected to do anything except to make noises, that may provide some insights into the expected rate increases to come, the next being in December.

If they try to sneak an extra one in next week that *could* roil the markets.

Try to be kind to those you meet, for everyone is bearing a burden of their own. Don't take people for granted, but thank them for the little things that they do. I have never seen people acting with such aggressive foolishness and petty bullying in a very long time. What are they thinking?

This is not us. This is no way to live. Don't let the increase in wickedness, and gross disregard for the truth and other people by some, harden and embitter your hearts. Don't sell your soul so cheaply.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.