"Wouldn't it be convenient for the oligarchs if their think tanks could somehow concoct a story, some plausible sounding theory, to persuade a portion of the world's population to hold dollar assets, expecting them to gain in value, even in the face of significant defaults and credit failures and a deteriorating return in GDP growth per marginal dollar debt? Or even better, getting them to remain fully invested in a series of artificially contrived dollar denominated financial assets that could be selectively 'pulled down' while keeping the overall scheme intact and running.

Bernays would be proud."

Jesse, 16 June 2010

"Growing concentration of power in the US has been under way for decades, and has now reached the point where how our economy and society are managed seems remarkably similar to the dominance of oligarchs in Russia or the role of few wealthy families in the shadows of China's CCP."

Harald Malmgren

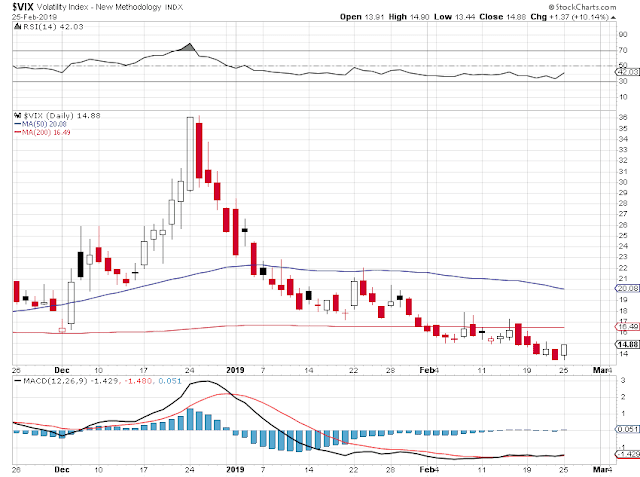

Stocks attempted to rally in the new week, and the last of the month of February.

But alas, the early morning pop faded substantially into the afternoon. But they did finish slightly positive to flat.

Gold and silver finished off a bit.

There will be a Comex option expiration at the end of the week.

The Dollar was lower.

A huge windstorm came blowing through our state today. No, it was not Trumpolini on his way to his golf course in Bedminster, NJ. It was the tail end of a strong weather system, that took down power lines and tree limbs.

Have a pleasant evening.