"As in the past so in the future, the wrong we have done, thought, or intended will wreak its vengeance on our souls, no matter whether we turn the world upside down or not.

Yuri Leonov, Icarus

Our knowledge of good and evil has dwindled with our mounting knowledge and experience, and will dwindle still more in the future, without our being able to escape the demands of ethics. In this utmost uncertainty we need the illumination of a holy and whole-making spirit— a spirit that can be anything but our reason."

Carl Jung, Psychology and Religion

"Be not deceived; God is not mocked. Whatsoever a man sows, that shall he also reap."

Galatians 6:7

"Even great men bow before the Sun; it melts hubris into humility."

Dejan Stojanovic

"But, what creates the most intense surprise,

His soul looks out through renovated eyes."

John Keats

"A crash is a watershed event, generational in its scope, always accompanied by an economic slump of greater than a year, often called a depression rather than a recession. Its effects are measured in years. It is a furnace in which the national character is tested and tempered, hammered into something different from what had gone before."

Jesse, 2008

The problem we are facing in American polite society is not that there is so much that is bad, but that there is so little that is genuinely good. This is the consequence of the moral imperative of the 'lesser of two evils.'

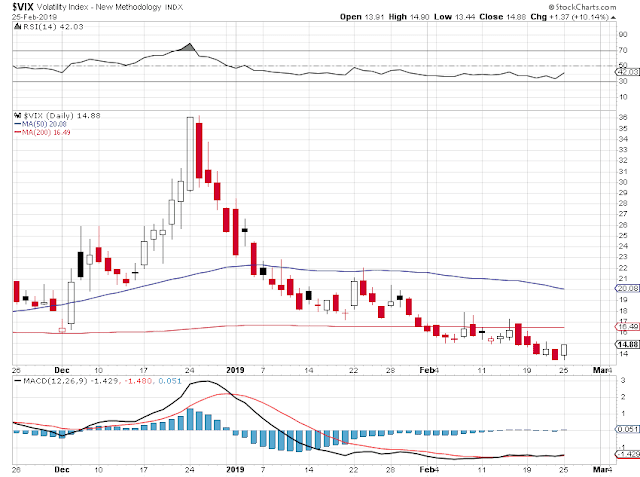

Stocks were wobbly— again.

One might expect that they have just completed a long run higher, and now stand looking at some formidable upwards resistance.

Gold and silver held steady, while the Dollar slumped a bit.

My cyclical calculations and trend forecasts suggest that July 2020 may be a decisive, if not pivotal, period in our time. I think I may have mentioned this once or twice before.

Have a pleasant evening.