“When an honest man speaks, he says only what he believes to be true; and for the liar, it is correspondingly indispensable that he considers his statements to be false. For the bullshitter, however, all these bets are off: he is neither on the side of the true nor on the side of the false.

His eye is not on the facts at all, as the eyes of the honest man and of the liar are, except insofar as they may be pertinent to his interest in getting away with what he says. He does not care whether the things he says describe reality correctly. He just picks them out, or makes them up, to suit his purpose.”

Harry G. Frankfurt, On Bullshit

Yesterday I said, "We may get a tweet fueled rebound of sorts. But it is unlikely to last."

We may get a little more upside, if Trump-o-weenie puts out more fantasy tweets about a trade deal, and Mnuchin mobilizes the Exchange Stabilization Fund.

But, the risks remain elevated, highly elevated.

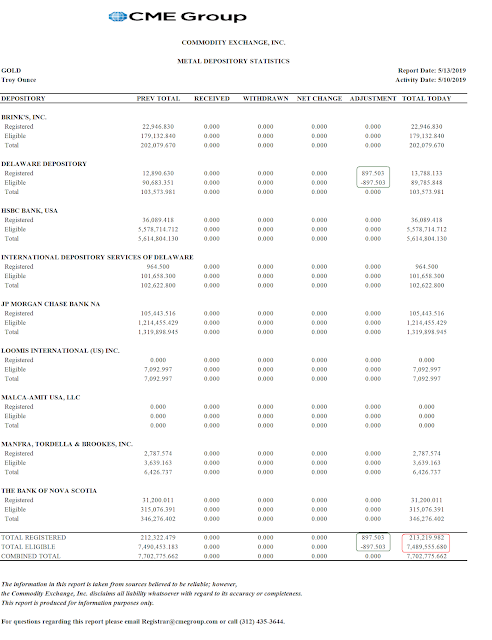

Gold hung in there today, despite a little profit-taking and a stronger dollar. We may have put in a 'W' double bottom. Let's see if that formation can activate on the chart.

Bloomberg *finally* fixed their intraday DX chart. Thank you guys. They have an excellent organization when it comes to collecting, organizing and presenting data.

As for the big picture, the 'recovery' may be faltering, the world may be teetering on the verge of economic stagnation, the US may be aggressively pursuing regime change in multiple countries, but at least the deficit is out of control, thanks in large part to the tax cuts for corporations and the ultra-wealthy.

As for the rest of us and these markets, hang on to your hats. We may be in for a rough ride.

Have a pleasant evening.