|

| Wall Street's finest discuss forming a 'stock exchange' under a nearby buttonwood tree |

And this morning the appetite for chasing bubbling assets with hot money was cooled even moreso by an intemperate statement (what a surprise) from Trump regarding his indifference to his fellows meeting with the Chinese in September to discuss a resolution to the ongoing trade war.

But fortunately once the Europeans went home to say hello to the wife and kids and have dinner, the denizens of Wall Street managed to walk the stock indices back up towards nearly unchanged, as they are often wont to do when they have the opportunity.

And the usual suspects among the advisors in the White House were reassuring that, again no surprise, Trump did not really mean to say when he in fact said, in writing.

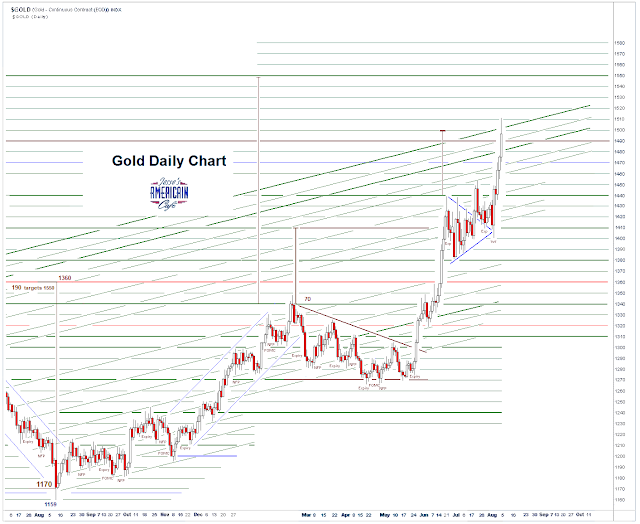

And so we had a bit of a risk-aversion hiatus, and the usual safe havens like gold, the Dollar, and the bonds faded a bit, and stocks were bought.

But there is a definite lack of whole hearted confidence in any of this trading, and cynically mechanical, so that time of positions being held must be down to milliseconds rather than a more judicious few hours or so.

So what does this mean?

It implies that, at least for now, the markets in the US will remain exceptionally fluid, which is a nice way of saying skittish and prone to event driven volatility.

If this up-and-down roller coaster continues on for the remainder of the summer, I would not be surprised if it does not shake itself apart before the winter.

Those of you who recognized the subtitle above, History Lesson, was a nod to the famous science fiction story by Arthur C. Clarke ought to be congratulated. And those select few who recall the moral of the story itself can very well accept it as an analogy for understanding the stock markets and economic models of today.

And those who do not are invited to watch a brief illustrative video included below.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.

History Lesson from DD on Vimeo.