"He made me understand, speaking to me saying, 'I have come to give you insight and understanding. At the beginning of your prayers for mercy the command was given, and I have come to tell this to you, for you are greatly loved. Therefore consider these words, and understand this vision.'"

Daniel 9:22-23

"So then, from now on, obey the Lord. Do not be stubborn and stiff-necked any more. For the Lord your God is the God of gods and the Lord of lords. He is the great and powerful God and is to be honored with fearful respect.

He does not show favor, and cannot be bought with money. He does what is right and fair for the orphan and the widow. He shows His love for foreigners by giving them food and clothing. So show your love for foreigners and strangers as well. For you too were foreigners and strangers in the land of Egypt. Fear the Lord your God. Work for Him, hold on to Him, and hold the truth in His name. For He is your glory and your God."

Deuteronomy 10:16-21

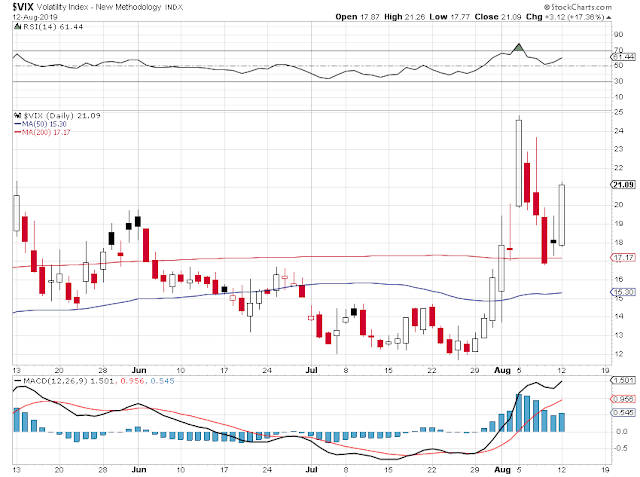

Stocks dropped steadily today, going out near the lows of the day.

The recent rally back from the previous plunge has ended, at about the fifty percent retracement level.

Gold rose sharply to $1520 in the afternoon before settling back to $1511 in what was a clear flight to safety.

This is the cash 'spot' price. The continuous contract futures actually rose to $1531.

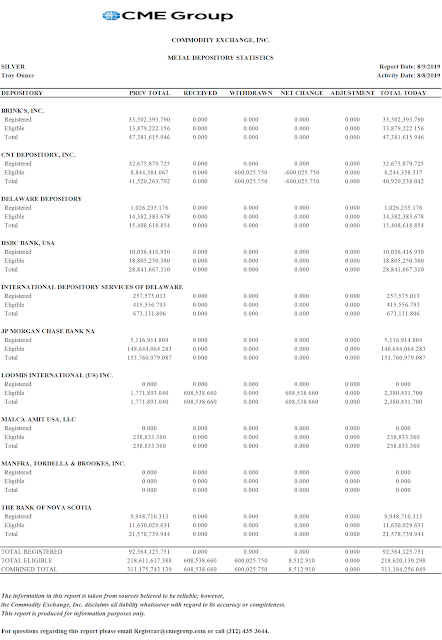

Silver had some participation, but does not have the same effect in an initial flight to safety.

Gold leads the way, but silver follows, often with bounding energy.

I have long term holdings in both metals. There is no need to favor one or the other over time.

What exactly sparked such a dramatic 'flight to safety?' Information is being disseminated asymmetrically. So we may have to wait a little while.

There will be a stock market option expiration on Friday.

Have a pleasant evening.