13 August 2019

12 August 2019

Stocks and Precious Metals Charts - Flight To Safety - Stock Option Expiration on Friday

"He made me understand, speaking to me saying, 'I have come to give you insight and understanding. At the beginning of your prayers for mercy the command was given, and I have come to tell this to you, for you are greatly loved. Therefore consider these words, and understand this vision.'"

Daniel 9:22-23

"So then, from now on, obey the Lord. Do not be stubborn and stiff-necked any more. For the Lord your God is the God of gods and the Lord of lords. He is the great and powerful God and is to be honored with fearful respect.

He does not show favor, and cannot be bought with money. He does what is right and fair for the orphan and the widow. He shows His love for foreigners by giving them food and clothing. So show your love for foreigners and strangers as well. For you too were foreigners and strangers in the land of Egypt. Fear the Lord your God. Work for Him, hold on to Him, and hold the truth in His name. For He is your glory and your God."

Deuteronomy 10:16-21

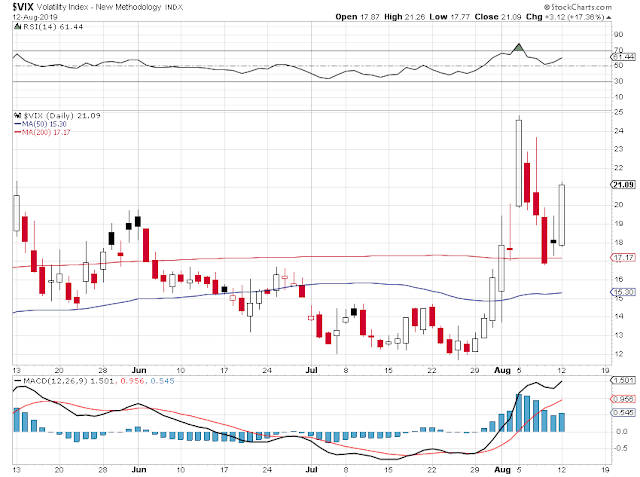

Stocks dropped steadily today, going out near the lows of the day.

The recent rally back from the previous plunge has ended, at about the fifty percent retracement level.

Gold rose sharply to $1520 in the afternoon before settling back to $1511 in what was a clear flight to safety.

This is the cash 'spot' price. The continuous contract futures actually rose to $1531.

Silver had some participation, but does not have the same effect in an initial flight to safety.

Gold leads the way, but silver follows, often with bounding energy.

I have long term holdings in both metals. There is no need to favor one or the other over time.

What exactly sparked such a dramatic 'flight to safety?' Information is being disseminated asymmetrically. So we may have to wait a little while.

There will be a stock market option expiration on Friday.

Have a pleasant evening.

History Lesson on Blindly Buying and Holding the Dips in Volatile Markets

"Stocks have fallen sharply as a trade war between the world’s two biggest economies ramped up in the past week, and according J.P. Morgan, it’s a good time to start buying.

Equity markets could still be in for a few more weeks of pain, but J.P. Morgan head of global and European equity, Mislav Matejka, expects an eventual rebound. In the meantime, he recommended that clients “look to buy the dip.”

“Our core view remains that one should use the prospective weakness as an opportunity to add,” Matejka said in a note to clients Monday. “We continue to believe that global equities will advance further before the next U.S. recession strikes.”

CNBC, Stocks still have room to fall, but look to buy the dip, JP Morgan says, 5 August 2019

I will never forget the sage wisdom and comfort that was given by one of the regulars on bubblevision in the bloody aftermath of the first tech 'dot com' bubble crash in 2001, after cheerleading it all the way up and beyond.

"Nobody made you buy stocks."

'Investing' by buying dips in volatile markets is a dangerous business, suitable only for professionals who know how to hedge and manage risk.

Especially the 'unexpected' risks.

"There is no cause to worry. The high tide of prosperity will continue."

Andrew W. Mellon, Secretary of the Treasury, September 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

R. W. McNeal, New York Herald Tribune, October 30, 1929

Category:

buy the dip

10 August 2019

Gold and Silver Commitments, Holdings, and Technicals - What Is Hidden Will Be Revealed

"Gold will be around, gold will be money when the dollar and the euro and the yuan and the ringgit are mere memories."

Richard Russell

"'We didn't truly know the dangers of the market, because it was a dark market,' says Brooksley Born, the head of an obscure federal regulatory agency -- the Commodity Futures Trading Commission [CFTC] -- who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. 'They were totally opposed to it,' Born says. 'That puzzled me. What was it that was in this market that had to be hidden?'"

PBS Frontine, The Warning

"Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort."

Antony C. Sutton

"Gold in US dollars is 25.7 % away from its all time high.

Gold in renminbi is 13.8 % away from its all time high.

Gold in euros is 3.2 % away from its all time high.

In many other (major) currencies gold is at an all time high."

Jan Nieuwenhuijs, the artist formerly known as Koos Jansen

Subscribe to:

Comments (Atom)