“The narcissist devours people, consumes their output, and casts the empty, writhing shells aside.”

Sam Vaknin

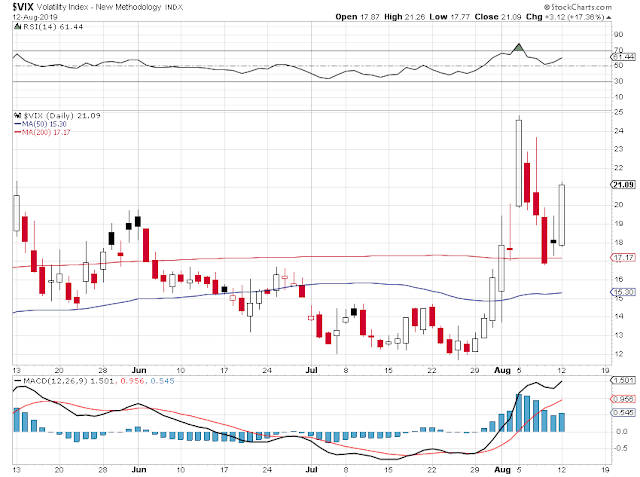

Stocks reversed their early declines and went on a rocket launch higher, and gold tanked after a strong overnight rally,

All thanks to a tweet suggesting that the Trump Administration would have a phone call with China after all. Call me!

The man-child gets his kicks by being able to pull levers with a few strokes of the keyboard. His acolytes and well-heeled entourage enjoy the foreknowledge of major market reversals. Trading on privilege and connections— that's what they do.

The CPI came in a little hot on the core this morning, giving some juice to the doleur du monde DX index, on the hopes that the economy is really strong after all, and the Fed will not have to cut rates much after all.

I was waiting to see how they might pull the trigger on this option expiration week, and we were certainly not disappointed.

It was an opportunity if one was set up for it. It is hard to be too cynical about our governing elites.

And if not, better to just ignore these jokers and their antics.

Let's see how the rest of the week goes, and how many turns on the tilt-o-wheel the financial system can take.

Have a pleasant evening.