"Cass shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction.” This indicates US GDP growth turns negative in Q3 or at latest Q4. World shipping data already confirming word trade slump deepening even before Trump tariffs."

Dr Harald Malmgren

"Hot money seeks out the conscious mispricing of risk. Capital, in the form of both money and personal talent, increasingly flows into malinvestment and the gaming of markets.

The productive economy languishes, left wanting for the lack of creative resources and attention. The bubble rises to unsustainable valuations— and fails, and a nation's capital is consumed. The next five years are not about winning, but surviving."

Jesse, 5 August 2019

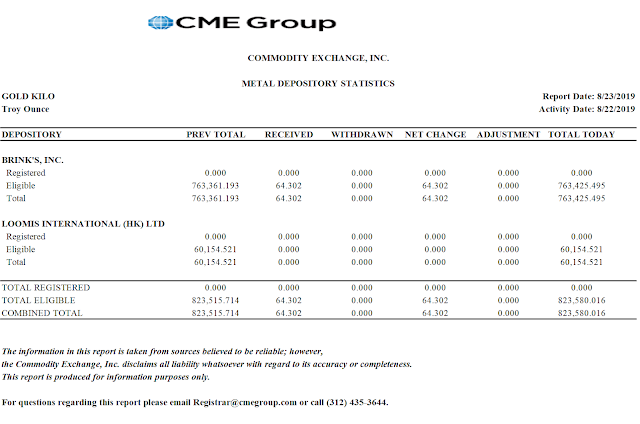

Citigroup dumped the gold contracts from its house account on Friday. The clearing report is below.

We will be having a minor Comex precious metals options expiration tomorrow.

Stocks and the metals went on a wild ride last night, in the latest episode of our bipolar President's trade war.

I spent a fruitful day taking Dolly to the groomer. She is pouting on her pillow, but very glad to be home.

Earlier this morning I did a minor rebuild on the carburetor and put a new fuel line in my Husqvarna chainsaw. The old fuel line pretty much fell apart. No wonder it would not start. lol.

The weather has turned glorious, an early taste of autumn. I am making borscht with beef bones and beets today, to be served cold with diced onion and sour cream. Yum.

Have a pleasant evening.