04 September 2019

03 September 2019

Stocks and Precious Metals Charts - Silver Takes the 19 Handle - Markets On Edge Before Payrolls and Powell

"U.S. factory activity unexpectedly contracted in August for the first time in three years as shrinking orders, production and hiring pushed a widely followed measure of manufacturing to its lowest level since January 2016. The Institute for Supply Management’s purchasing managers index fell to 49.1 in August, weaker than all forecasts in a Bloomberg survey of economists, data released Tuesday showed.

The Gathering Tweetstorm

Figures below 50 signal the manufacturing economy is generally contracting. The group’s gauge of new orders dropped to a more than seven-year low, while the production index shrank to the weakest level since the end of 2015. Faltering manufacturing could complicate President Donald Trump’s re-election campaign as recent data undermines one of his signature promises for a strong economy.

Stocks extended declines and the yield on 10-year Treasuries fell sharply Tuesday after the data was released. The dollar weakened."

Bloomberg, U.S. Manufacturing Contracts for First Time in Three Years

“Because silver and gold have their value from the matter itself, they have first this privilege, that the value of them cannot be altered by the power of one, nor of a few commonwealths, as being a common measure of the commodities of all places. But base money may easily be enhanced or abased.”

Thomas Hobbes

Gold and silver are the antithesis of the primacy of the power of the state to arbitrarily and sustainably mandate value and create wealth as it wishes at will.

Anyone who has personally witnessed the collapse of artificially managed maintained exchange rates into black markets knows this.

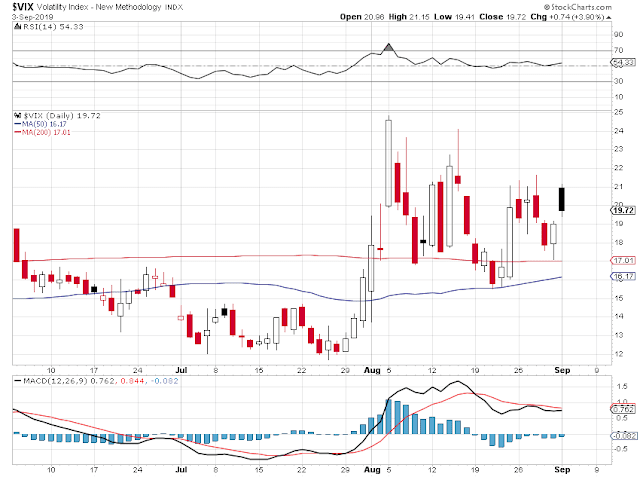

Tariffs and a marathon tweetstorm had US equities reeling a bit over the weekend.

Even an effort to turn it around during the quiet futures overnight trading hours couldn't help, and so stocks finished lower after the three day weekend.

The Manufacturing ISM missed this morning, and at 49.1 actually showed a slight contraction.

Risk off was the big story, with the Dollar and Gold higher.

But the real mover and shaker was once again silver, which took out the $19 handle in the morning with some authority, and then held it during the afternoon and into the close.

Wow.

Jay Powell will be speaking in Zurich near the end of the week.

There will be a Non-Farm Payrolls report on Friday, which may play backup to Fed Chair Powell's remarks.

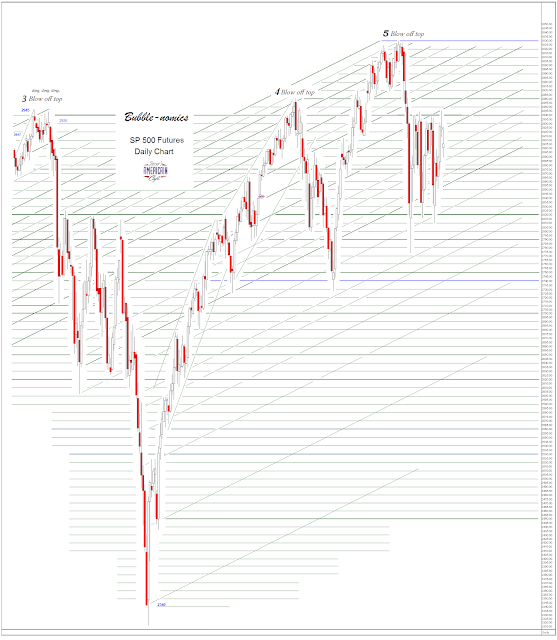

It is fairly obvious that a market crash and a recession would have seriously negative effect on Trumpolini's 2020 election ambitions.

Let's see how the bulls respond to this. And who may decide to give them a helping hand.

And oh by the way, Insiders Are Selling Stock Like It's 2007

Have a pleasant evening.

Category:

gold/silver ratio,

JPM Silver Short,

silver breakout

Rates, Recessions, Rentiers, Oh My!

"The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil. Perhaps this is inherent. In a community where the primary concern is making money, one of the necessary rules is to live and let live. To speak out against madness may be to ruin those who have succumbed to it. So the wise in Wall Street are nearly always silent. The foolish thus have the field to themselves. None rebukes them."

John Kenneth Galbraith, The Great Crash of 1929

Category:

credit card usury,

Interest Rates

Subscribe to:

Comments (Atom)