"As I have stated strongly before, and just to reiterate, if Turkey does anything that I, in my great and unmatched wisdom, consider to be off limits, I will totally destroy and obliterate the Economy of Turkey (I’ve done before!)"

Donald J. Trump

"China uses a host of monopolizing strategies to extend its geopolitical and commercial power, everything from below cost pricing to grab market share, patent trolling, espionage, mergers, and financial manipulation. In fact, the CCP is best understood as a giant monopoly that also controls a nation of 1.4 billion people and a large military apparatus...

China’s biggest asset in gaining power was how most people in the West just didn’t realize that the CCP aimed to use it. Now China’s cover is blown. The raw exercise of power to censor a random Houston Rockets basketball executive has made millions of people take notice. Everyone knows, the Chinese government isn’t content to control its own nation, it must have all bow down to its power and authority.

Matt Stoller, How Joe Biden Empowered China's Censorship of the NBA

Matt overstates the headline I think. The empowerment of China may have gone into higher gear with Bill Clinton perhaps, but has been fully supported by every President, both parties, and especially the moneyed interests in the US, who place their short term greed first and foremost.

Follow the money. China is certainly not alone among organizations, and even nations, in playing on the personal greed, divided loyalties, and lust for power of our political and financial class.

This in itself is nothing new. But the extent of it, and the fashionable acceptance of it amongst our society's elites, the industrialization of political corruption and big money in politics, has been breathtaking.

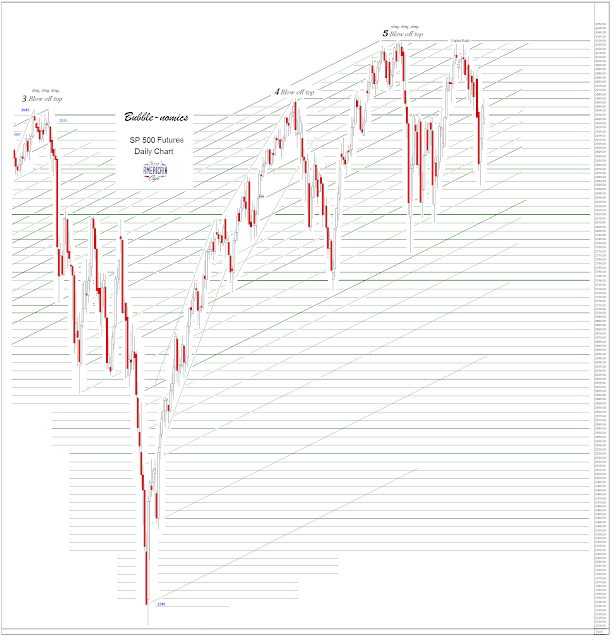

Stocks were wobbly for much of today.

Trading volume was lackluster and the market action for the most part was 'dull.'

There was a brief rally around the middle of the day, when Larry Kudlow lit up the trading algos with talk about the progress being made in a trade deal with China.

That wore off fairly quickly, as the human beings quickly realized this was just another story designed to pump up the markets, and that there was no substance to it.

Gold and silver were off a bit and the Dollar was marginally higher in a seesaw session.

Have a pleasant evening.