"Totalitarianism in power invariably replaces all first-rate talents with crackpots and fools whose lack of intelligence and creativity is the best guarantee of their loyalty.”

Hannah Arendt, The Origins of Totalitarianism

"Where is dignified modesty and a firmness of virtue of any use, now that blasphemy is in power, and justice is ignored, and there is no law but lawlessness, and few make an effort to hold back the wrath of the gods?”

Euripides, Iphigenia in Aulis

“When political leaders set a negative example, professional commitments to just practice become more important. It is hard to subvert a rule-of-law state without lawyers, or to hold show trials without judges. Authoritarians need obedient civil servants, and concentration camp directors seek businessmen interested in cheap labor.”

Timothy D. Snyder, On Tyranny

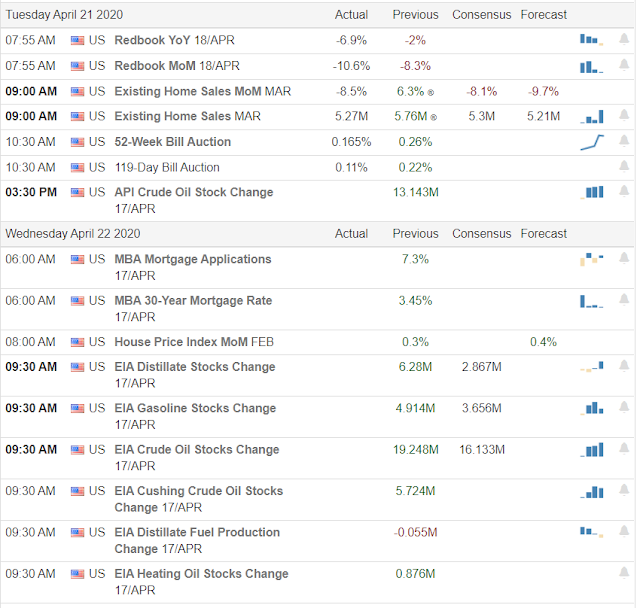

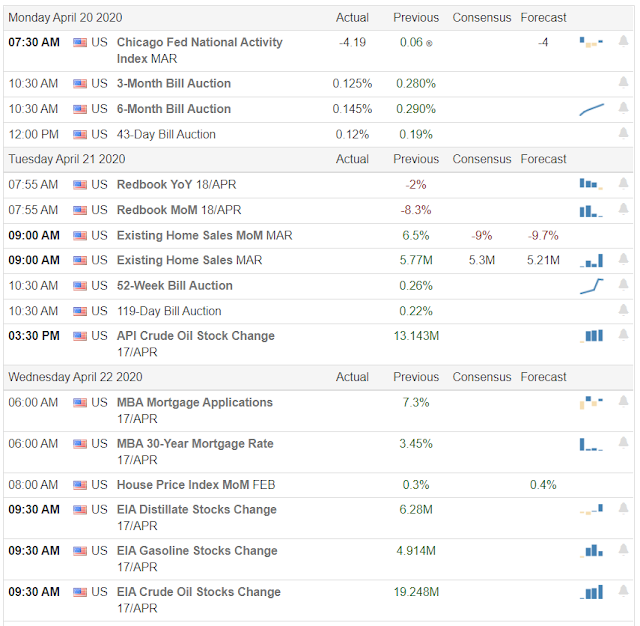

I have included a graphic above from a piece I had originally posted a couple of crises ago on a site that has long ceased to exist.

History does repeat, or at least rhyme, if you will. Each crisis has its own attributes and tone, but they tend to have much in common.

It is good to recall that we are in a period now that is very new to us, not having seen a pandemic like this in the US since the beginning of the 20th century.

We do not think about it now, but some day in the future you will be among of the few who actually remember what this was like, what is was to join the select group of 'insiders' who quarantined themselves in the hopes of holding back the lethal effects of an epidemic.

And you may find yourself trying to explain to your grandchildren what the political and cultural circumstances were like. And why certain things were done the way in which they unfolded.

It is good to remember that we are just stumbling down the long halls of history like our parents and grandparents, who fumbled their own way through the darkness, trying to follow the light.

Stocks were sold off a bit hard today. It seemed to be coming giving the unreasonable optimism of last week that our current situation was mostly done, and it was time to get back to things as they were.

Oil was hammered again. Of course the slack demand is a huge factor, as it is with any practical commodity. And the price war that is ongoing among OPEC+ is a major input as well.

But I cannot help but feel that some of the powerful Wall Street insiders are taking advantage of the situation, and the situational aspects of this rollover in the futures contracts, to get some quick money and while dishing out some pain, ripping off some faces, and so forth, as they are often wont to do.

Well, we'll see how this unfolds, among other things.

What has been hidden will be revealed, and what has been concealed will be made known.

A crisis shows the characters of people, and of systems that they have organized.

And brother, do we have some odd characters on the big stage in Washington. It is almost unbelievable.

I think it might get worse still, before it gets better. And it is only a few more months to July.

Have a pleasant evening.