The Fed came through with their 'uber-dovish' FOMC statement, for which Wall Street wiseguys were yearning.

And it wasn't because the economy is just that good.

The tech weenies gave their testimony about monopoly and competition to the House today.

The SP 500 and the Russell 2000 were pulling the weight today, although a few of the big name techs were leading the way higher as well.

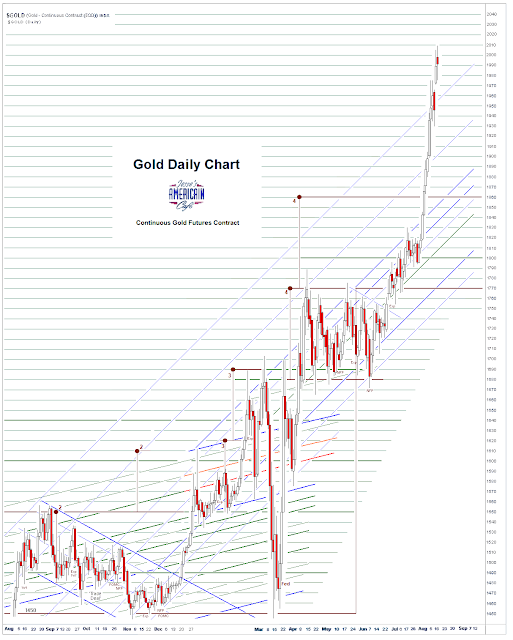

Gold and silver managed to move a little higher again today.

The dollar moved lower, towards the 93 level. How low can it go? I should update my longer term DX dollar chart.

One of the talking heads on Bloomberg referred to gold today as an 'unreliable boyfriend' among risk aversion assets.

And further, that it is vulnerable to a return to normalcy in interest rate yields from a robust economic recovery.

So don't bother with gold if you want a safe and stable haven from economic craziness.

As if. And my garden is vulnerable to a meteor strike

I think is almost the very definition of a alternative safe haven.

I seem to recall that financial legend Bernard Baruch once said, "Gold has 'worked' down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

With the current crew of financiers and politicians in charge, I think we can find some comfort in taking a lesson from history, as most of the central banks in the rest of the world have done.

Have a pleasant evening.